I hope you get value out of this blog post.

Are you maximizing your efficiency and client satisfaction as a financial advisor?

A survey revealed that while the majority of business owners (63%) work more than 50 hours a week, they would prefer to work just 42 hours.

Time blocking is a strategic time management method that can help you align your work habits with your preferred schedule.

Time blocking is a time management approach where you divide your day into blocks, each focused on completing specific tasks or task groups.

Unlike traditional to-do lists, which dictate what you need to do, time blocking dictates when you will do it.

This approach helps in creating a structured schedule that can lead to more productive work and better work-life balance.

One of the primary advantages of time blocking is its ability to help financial advisors like yourself focus on tasks without the interference of multitasking.

Dedicating set periods to single tasks encourages deep work, where you can fully immerse yourself in a task without distractions.

This deep work is important in the financial advisor field, where tasks often require high levels of concentration and precision.

Another significant benefit is the reduction of decision fatigue.

By planning your day, you save mental energy for important tasks like client finances and growing your business — helping you make better decisions.

Time blocking also fosters a greater sense of control over your schedule.

By setting aside time for administrative tasks, client interactions, and personal development, you ensure that all aspects of your professional life receive attention.

This holistic approach to time management can lead to improved job satisfaction and a better balance between work and personal life.

? Time Blocking in Reality

In practice, time blocking can look different for each financial advisor, depending on their specific roles, responsibilities, and working style.

However, the fundamental principle remains the same — divide your day into dedicated blocks of time for specific activities, and stick to this schedule as closely as possible.

For financial advisors and financial coaches, mastering time blocking is vital to enhance productivity and client service quality.

Let's discuss some key techniques that can be effectively incorporated into your routine.

The first step in effective time blocking is identifying high-impact activities.

For financial advisors, these activities typically include:

It's important to recognize which tasks contribute most significantly to your goals and client satisfaction (so think this over properly).

High-impact activities should be given priority in your schedule to ensure that the most critical aspects of your job are addressed first.

Here are tools and methods you can use for this:

| Tools | Description | Instructions |

| Eisenhower Matrix | Categorizes tasks based on urgency and importance. Helps prioritize effectively. | Place tasks in the appropriate quadrant and focus on urgent and important ones first. |

| ABC Method | Assigns priority status ('A', 'B', 'C', etc.) to tasks. Ensures critical tasks come first. | Prioritize tasks as 'A,' 'B,' 'C,' etc., and start with 'A' tasks. |

| 80/20 Rule (Pareto) | Identifies the most impactful 20% of tasks that yield 80% of results. Optimizes efforts. | Identify tasks with significant impact and concentrate efforts on them. |

| Goal-Oriented Task Lists | Aligns tasks with broader goals, clarifying their contribution to long-term objectives. | List tasks related to each goal and prioritize based on goal importance. |

| Digital Tools and Apps | Utilizes digital tools like Trello, Asana, or Todoist for task management and progress tracking. | Choose a digital tool, create tasks, set deadlines, and monitor progress while adjusting priorities. |

These techniques help ensure that your time is spent on activities that directly contribute to your professional success and client satisfaction.

Prioritizing tasks allows for a more strategic approach to time management so that every block of time is utilized effectively for the most impactful activities.

Allocating specific time slots for tasks is key to effective time blocking — it means setting fixed start and end times for each task in your day.

Here’s how you can do this:

Effective allocation of time also involves balancing various types of tasks:

⌚ Flexibility Within Time Blocks

While it’s important to stick to your schedule, it’s equally important to maintain some flexibility.

Allow some buffer time between tasks to accommodate any overruns or unexpected tasks. This flexibility ensures that your schedule is realistic and sustainable.

For financial advisors and coaches, minimizing distractions is critical to making the most of each time block.

Here are some strategies to help reduce interruptions and maintain focus:

| Strategy | Description | What to Do |

| Create a dedicated workspace | Have a designated area for work, separate from personal spaces, to minimize distractions. Ensure it's organized and conducive to productivity. | Set up a dedicated workspace for work tasks, and keep it organized and free from personal distractions. |

| Limit digital distractions | Turn off non-essential notifications on your phone and computer. Use apps that block distracting websites during work hours. | Disable unnecessary notifications on your devices and consider using apps that prevent access to distracting websites during work hours. |

| Set expectations with others | Inform colleagues, family, and friends about your working hours and time-blocked schedule to reduce interruptions. Set clear boundaries. | Communicate your work hours and schedule to colleagues and loved ones to minimize interruptions and establish clear boundaries. |

| Use the Pomodoro Technique | Work for a set period (typically 25 minutes) and then take a short break. This technique helps maintain concentration and prevents burnout. | Implement the Pomodoro Technique by setting focused work intervals followed by short breaks to boost productivity and prevent fatigue. |

| Plan for interruptions | Allocate 'buffer time' in your schedule for unforeseen interruptions. This helps manage minor distractions without derailing your schedule. | Set aside buffer time in your schedule to address unexpected interruptions or minor distractions without disrupting your entire work plan. |

In addition, the environment in which you work can significantly impact your ability to stay focused.

Consider the following:

It's about creating a work environment and habits that support deep, focused work, allowing for more efficient and effective use of time.

I mentioned this earlier as part of technique #3’s strategy, but I want to dedicate another section to it since this is one of the most effective techniques I have tried.

A little background here:

Pomodoro (named after the tomato-shaped kitchen timer) is a popular time management method developed by Francesco Cirillo in the late 1980s.

This technique involves breaking work into short intervals, traditionally 25 minutes in length, separated by short breaks (these intervals are known as "Pomodoros.")

Here’s how to do this technique:

| Step | Description | Tips |

| Choose a task | Begin by selecting a task or series of tasks to work on. | Pick a task that requires focused attention and can be completed in 25 minutes. |

| Set the timer | Set up a timer for 25 minutes and dedicate yourself to working solely on the task until the timer goes off. | Use a timer or Pomodoro app to track the intervals accurately. |

| Work on the task | During this period, give your full attention to the task at hand. If a distraction crosses your mind, jot it down, and promptly return to the task without delay. | Minimize interruptions and stay fully engaged in your work. |

| End work when the timer rings | Once the timer goes off, put a checkmark on a piece of paper to note one Pomodoro completed. | Celebrate your progress and acknowledge completing a focused work session. |

| Take a short break | Take a 5-minute break. This is crucial as it gives your brain a chance to relax and reset before the next Pomodoro. | Use this time to stretch, breathe, or briefly step away from your workspace. |

| Repeat | After four Pomodoros, take a longer break, typically 15-30 minutes. This helps to recover and ensures you're ready for the next round of focused work. | Reflect on your achievements during the longer break and plan the next tasks. |

? Adapting the Pomodoro Technique

Financial coaches/advisors like yourself can adapt this technique to fit your workflow.

For example:

Implementing time blocking in your daily routine as a financial advisor can dramatically improve your productivity and work-life balance.

Here’s a step-by-step guide to integrating any of the techniques I mentioned above into your daily schedule:

| Step | Substep | Description |

| Conduct a time audit | Track your current time use | Spend a week tracking your current time usage, noting client meetings, administrative tasks, and breaks. |

| Identify time wasters | Identify activities that consume excessive time or don't significantly contribute to your professional goals. | |

| Define your priorities | List key responsibilities | List your primary responsibilities, including client interactions, financial planning, research, and education. |

| Set goals | Define what you want to achieve with time blocking, such as increased productivity, better client service, or personal time. | |

| Create your time blocking plan | Allocate blocks for different activities | Allocate specific time blocks for various tasks, such as deep work for financial analysis and shorter blocks for emails and admin tasks. |

| Schedule breaks | Include short breaks for rest and recharge, especially after intensive work sessions. | |

| Use a digital calendar | Utilize tools like Google Calendar or Microsoft Outlook for visual representation and organization of your time blocks. | |

| Implement the plan | Start gradually | Begin implementing time blocking for critical parts of your day and gradually expand its use. |

| Communicate with clients and colleagues | Inform clients and colleagues about your new schedule, especially if it impacts your availability for meetings or calls. | |

| Evaluate and adjust | Review your progress weekly | At the end of each week, review your schedule, assessing what worked well and what needs improvement. |

| Make adjustments | Be flexible and adjust your time-blocking schedule as needed, adapting to changing priorities and responsibilities. | |

| Maintain discipline and flexibility | Stay committed | Adhere to your time blocks as closely as possible, treating them like fixed appointments in your daily routine. |

| Allow for flexibility | Be prepared to adjust your blocks if urgent client issues or unexpected opportunities arise, maintaining a balance between discipline and adaptability. |

By following these steps and being consistent with your approach, you will soon find that:

After mastering time-blocking techniques, the next logical step is to optimize your client communication and documentation process.

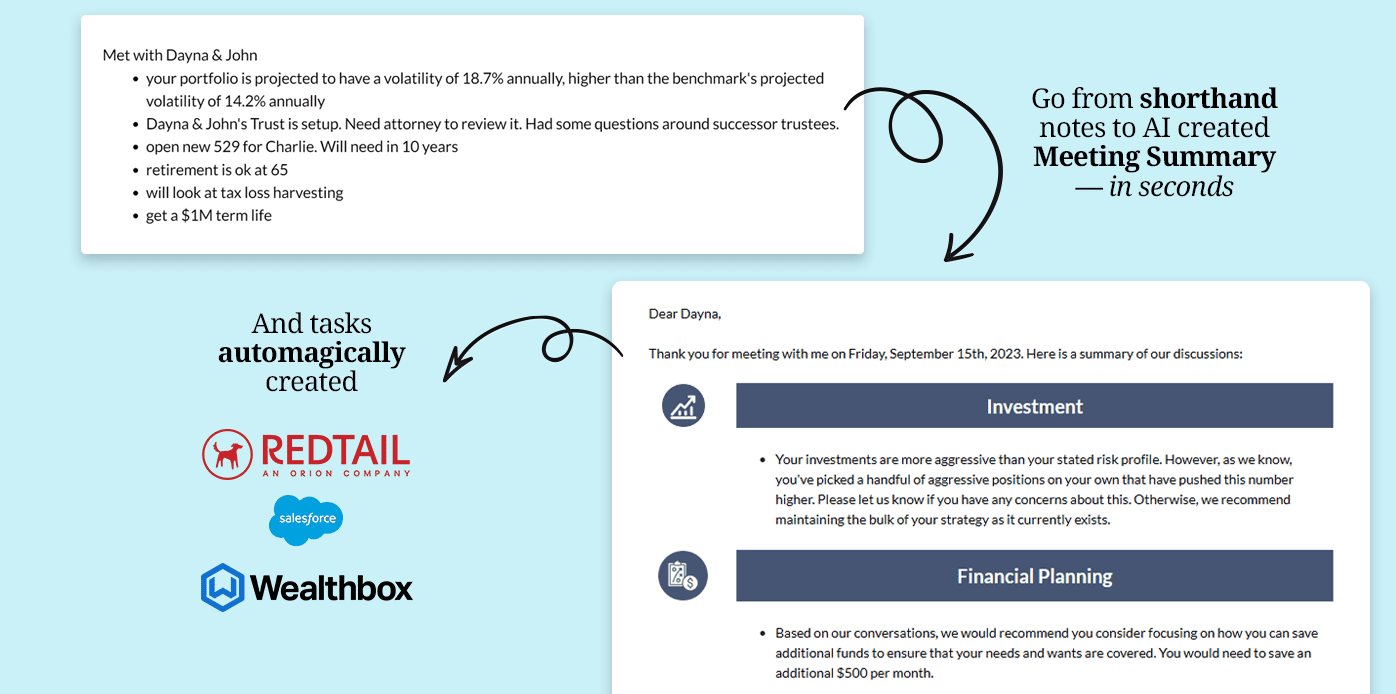

This is where Pulse360 becomes an indispensable tool for financial advisors, where you can revolutionize the way you interact with and manage your clients.

With plans tailored to every need:

Embrace the power of efficient client management with Pulse360.

Let our platform elevate your practice, freeing up more time for what matters most – providing top-notch financial coaching and advice.