I hope you get value out of this blog post.

Did you know a striking 97% of employers value soft skills as equally or more crucial than hard skills? This insight significantly applies to the financial advisory domain.

Top-performing financial advisors excel not only in financial acumen but also in soft skills like emotional intelligence and client relationship management.

These skills are vital in navigating transference and countertransference, often overlooked yet critical aspects of client relationship management in financial advising.

Transference is when someone takes the emotions or expectations from one relationship and applies them to another, especially in new or current relationships.

In a financial advising context, this means a client might treat you based on how they feel about someone else — like a parent — rather than based on your actual interactions with them.

Understanding transference is essential for financial advisors and coaches because it can have a significant impact on the client-advisor relationship.

When unchecked, transference can distort the client's perception of your advice or guidance, possibly leading to misunderstandings, unrealistic expectations, or impaired decision-making.

There are three types of transference:

| Type | Description | Example |

| Positive Transference | Client has overly favorable perceptions of the advisor. | Client sees the advisor as a parental figure and places complete trust in their advice. |

| Negative Transference | Client has unfavorable or skeptical views of the advisor. | Client resents the advisor due to a past experience with another authority figure and is confrontational. |

| Ambivalent Transference | Client has mixed feelings towards the advisor, both positive and negative. | Client alternates between admiring the advisor and feeling resentful, leading to inconsistent engagement. |

? Manifestation and Signs

Transference can manifest in various ways.

Being aware of transference helps you navigate it effectively.

Signs may include:

Countertransference is the flip side of transference:

It’s when you, as the financial advisor or coach, unconsciously project your own feelings, expectations, or past experiences onto the client.

This can manifest as either positive or negative emotional reactions, and it can affect your professional judgment and objectivity.

If you're emotionally invested in a client's situation or let your personal feelings dictate your guidance, it can compromise your effectiveness and professionalism.

There are two types of countertransference:

| Type | Description | Example |

| Positive Countertransference | Advisor has overly favorable views or feelings toward the client. | Advisor becomes overly involved in the client’s life, going beyond professional boundaries. |

| Negative Countertransference | Advisor has negative or judgmental feelings towards the client. | Advisor feels frustrated with the client and becomes detached or less engaged in their case. |

? Manifestation and Signs

You might find yourself overly sympathetic to a client's situation, leading you to offer advice that's not necessarily in their best financial interest.

On the flip side, you might feel frustrated or annoyed with a client, causing you to become detached or less engaged in their case.

It's crucial to be self-aware and notice signs of countertransference, which can include:

Navigating the emotional complexities of transference and countertransference is vital for any financial advisor or coach.

Failure to manage these psychological phenomena can lead to several risks that can adversely impact both you and your clients.

When emotions run high, both advisors and clients are more susceptible to making decisions based on feelings rather than facts.

For example:

Financial advising is about making sound, rational decisions.

Emotional judgments can lead to poor financial choices that don't align with the client's best interests or long-term goals.

Emotional involvement can blur the lines between professional and personal boundaries.

For example:

Crossing professional boundaries can lead to ethical dilemmas and may undermine your credibility and reputation in the long term.

The relationship between an advisor and a client should be built on trust, objectivity, and mutual respect.

Transference and countertransference can strain this relationship by introducing emotional biases.

For example:

A strained relationship compromises the effectiveness of financial advising leading to client dissatisfaction, loss of clients, and even legal complications in extreme cases.

Managing transference effectively is crucial for maintaining a healthy and productive client-advisor relationship.

Here are some practical steps you can take:

Being aware of your own emotional state and reactions is the first step in identifying transference.

Pay attention to any strong emotional responses you might have during client interactions, and question whether these feelings are a result of the client's transference.

Here's an overview of the steps involved:

| Steps | Description | Importance |

| Self-Monitoring | Keep track of your emotional responses during client interactions. | Being aware of your emotional state allows you to recognize when you might be reacting to transference. |

| Reflection | After client meetings, take some time to reflect on the interaction. | Allows you to discern whether your emotional responses are a result of transference or based on the actual events of the meeting. |

| Seek Feedback | Seek feedback from trusted colleagues or supervisors. | External feedback can highlight blind spots and provide insights you might not have considered. |

| Journaling | Keep a journal documenting your feelings and observations after client meetings. | Helps you track patterns over time, making it easier to identify recurring issues related to transference. |

| Professional Development | Invest in training sessions, workshops, or literature focused on emotional intelligence and client relationship management. | Provides you with the tools you need to better manage transference and improve client relationships. |

Self-awareness enables you to distinguish between your client's feelings and your own reactions — helping you maintain objectivity and provide advice in the client’s best interest.

Clearly define the scope and limits of your professional relationship with clients.

This can include setting meeting agendas, reiterating the nature of the advisor-client relationship, and even putting boundaries on communication methods and times.

Here's an overview of the steps involved here:

| Steps | Description | Importance |

| Define the Scope | Clearly outline the services you will provide and what you won't cover. | Sets client expectations right from the start, minimizing the risk of transference-related misunderstandings. |

| Communication Limits | Specify preferred methods and times for communication, such as emails during business hours only. | Helps maintain a professional relationship and prevents the blurring of personal and professional lives. |

| Meeting Agendas | Set clear agendas for each client meeting, outlining what will and won't be discussed. | Keeps the conversation focused and reduces the chances of emotional topics leading to transference. |

| Reinforce Professional Role | Periodically remind clients of your role as a financial advisor, not a friend or therapist. | Reinforces the professional nature of the relationship, reducing the likelihood of emotional entanglement. |

| Document and Review | Keep records of all client interactions and regularly review them to ensure boundaries are being maintained. | Provides a factual basis for the relationship, making it easier to identify and address any boundary issues. |

Establishing boundaries helps to mitigate the effects of transference by making the professional framework of the relationship clear.

It reduces the likelihood of emotional entanglement and allows for a more focused and effective advising process.

Regularly consult with peers or supervisors to discuss any challenging emotional dynamics that you sense are affecting your client relationships.

This is a safe space to explore your observations and feelings, and to seek advice on how to handle specific situations.

Here's an overview of the steps involved:

| Steps | Description | Importance |

| Identify a Support Network | Create a list of trusted colleagues, mentors, or supervisors you can consult with. | Provides you with a go-to resource for addressing challenging emotional dynamics in your client relationships. |

| Regular Check-ins | Schedule regular meetings with your support network to discuss your observations and feelings. | Consistent check-ins make it easier to catch early signs of transference and take proactive measures. |

| Case Reviews | Discuss specific client cases, while maintaining confidentiality, to get feedback and advice. | Peer insights can help you identify blind spots and suggest strategies for managing transference effectively. |

| Seek Expert Guidance | For complex cases, consider consulting with professionals skilled in psychology or client relations. | Expert advice can offer more advanced strategies for managing emotional dynamics. |

| Reflect and Adjust | Take time after each consultation to reflect on the advice received and make necessary adjustments in your approach. | Allows you to continually refine your methods, improving your effectiveness in managing transference. |

Peer consultation provides a fresh perspective and can help you identify blind spots you might have missed.

This is especially helpful for catching early signs of transference and taking proactive steps to address it.

Managing countertransference is equally important for ensuring a healthy and effective client-advisor relationship.

Below are some strategies, along with an expanded description of each:

Invest time in developing your emotional intelligence skills, such as self-awareness, empathy, and social skills.

This will help you recognize your own emotional reactions and understand the emotions of your clients.

Here's an overview of the steps involved:

| Steps | Description | Importance |

| Self-Assessment | Regularly evaluate your emotional strengths and weaknesses. | Gives you a baseline to understand where you need improvement. |

| Active Listening | Focus on truly hearing what your client is saying, rather than formulating your next response. | Helps you tune into the client's emotions and needs, making you less likely to project your own feelings onto them. |

| Practice Empathy | Make a conscious effort to understand things from the client's perspective. | Enhances your ability to relate to clients without letting your own emotions cloud your judgment. |

| Emotional Regulation | Develop techniques to manage your emotions, such as deep breathing or taking a moment to pause. | Allows you to maintain your composure and objectivity, even when dealing with emotionally charged situations. |

| Improve Social Skills | Work on your interpersonal skills, like communication and conflict resolution. | Better social skills make it easier to navigate complex emotional dynamics without falling into the trap of countertransference. |

High emotional intelligence enables you to separate your own feelings from those of your client, thus reducing the impact of countertransference on your advice and decisions.

Attend workshops, seminars, or courses that focus on the psychological aspects of client relationships.

Many of these trainings offer practical techniques for recognizing and managing countertransference.

Here's an overview of the steps involved here:

| Steps | Description | Importance |

| Identify Training Needs | Assess your current skill set and identify areas that require improvement, particularly in managing emotional dynamics. | Helps you target your training efforts more effectively. |

| Research Options | Look for workshops, seminars, or courses that focus on emotional intelligence, client relationships, and psychological aspects of advising. | Allows you to find the most relevant and effective training programs. |

| Participate Actively | Engage fully in the training sessions, participating in discussions and exercises. | Maximizes the learning experience and helps you internalize the skills being taught. |

| Apply Learning | Implement the techniques and strategies you've learned in your daily interactions with clients. | The real test of any training is its practical application; this helps you gauge its effectiveness. |

| Continuous Learning | Keep up-to-date with new methods and research in the field, and consider periodic refresher courses. | Ensures that your skills remain current and effective in managing countertransference. |

Professional training equips you with the tools and techniques to identify countertransference early and handle it effectively — maintaining your objectivity and professional integrity.

Build a support network of colleagues and mentors who you can consult with when dealing with complex emotional situations.

Sharing experiences and discussing cases (while maintaining client confidentiality) can provide valuable insights.

Here's an overview of the steps involved here:

| Steps | Description | Importance |

| Build a Support Network | Identify colleagues, mentors, or supervisors who you can turn to for advice or consultation. | Creates a reliable resource for gaining fresh perspectives and emotional support. |

| Schedule Regular Check-ins | Set up routine meetings or discussions with your support network to talk about challenging client cases. | Consistency helps you catch early signs of countertransference and provides ongoing support. |

| Share and Discuss | Openly share your experiences and challenges, while maintaining client confidentiality. | Peer discussion can offer valuable insights and alternative strategies you might not have considered. |

| Seek Constructive Feedback | Ask for specific feedback on how you're managing emotional dynamics in client relationships. | Helps you identify areas for improvement and reinforces positive behaviors. |

| Reflect and Take Action | After each discussion or meeting, reflect on the advice and insights received, and implement changes accordingly. | Enables you to continuously refine your approach to managing countertransference. |

A support network offers alternative perspectives and may help you identify blind spots in your own behavior or thought processes, making it easier to manage countertransference.

Understanding and managing transference and countertransference are crucial for maintaining a successful client-advisor relationship in the financial sector.

By being self-aware, setting clear boundaries, and seeking professional development, you can provide objective and effective financial advice.

The end goal is to build a relationship based on trust, objectivity, and mutual respect.

You've seen how crucial it is to manage transference and countertransference in client relationships.

But emotional acumen is just half the battle—you also need efficient tools for the operational side of your practice.

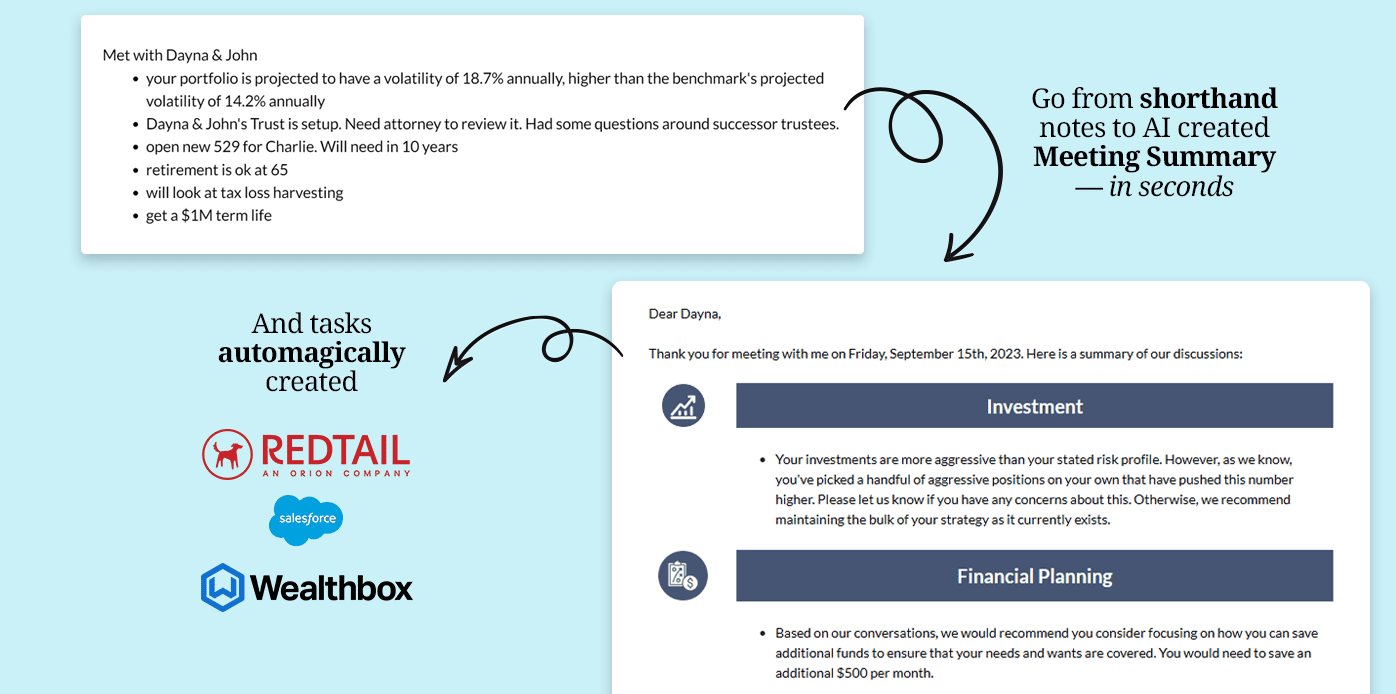

This is where Pulse360 shines. Designed specifically for financial advisors, it streamlines your documentation process, especially after you've identified biases using diagnostic questionnaires

With plans tailored to every need:

Don't let tedious manual documentation hold you back. Elevate your practice and impress your clients—make Pulse360 your go-to tool today.