I hope you get value out of this blog post.

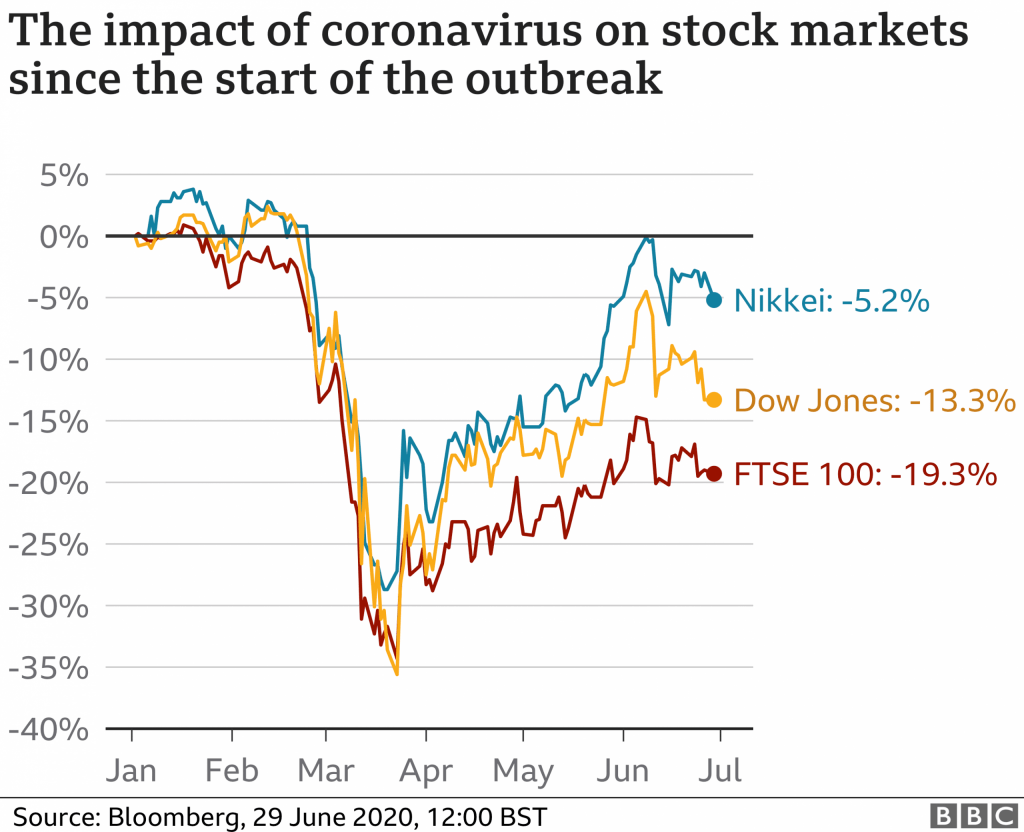

As markets reel in response to the recent pandemic, the financial advisory industry faces a host of uncertainties. Clients are seeking advice and reassurance, while advisors have their own worries and investment challenges. As well as finding new ways to deal with clients, advisors have had to navigate administrative issues and furlough or even make staff redundant.

In this post we’ll examine how the crisis is impacting financial advisors along with some ways to keep your business on track.

Some advisors are reporting a fall in new business

Covid-19 appears to be having a larger impact than previous market crashes. For some advisors lockdown is putting a check on new business acquisition. When questioned 62% of advisors who took part in a recent Facebook survey said they had seen new enquiries fall.

The reason? According to many advisors it’s because new clients need to have that personal connection before they sign up. Although video calls can work well, many potential clients still like to ‘meet’ their advisor in person.

Another reason for the decrease in demand could be because many of the catalysts to setting up new financial plans (house moves, marriages, etc.) are on hold..

Other advisors are seeing an increase in enquiries

The picture when it comes to new business acquisition is not the same across the board:

While technology may be putting off some first time investors, others are actively seeking financial advice for the first time.

Existing clients are concerned about their long-term objectives

During the pandemic advisors have been spending more time speaking with clients. According to recent research six in 10 advisors said they’ve experienced a 25% increase in inbound contact from clients. As you would expect many clients are seeking reassurance about their investments, as well as information on self-employment and payment deferrals.

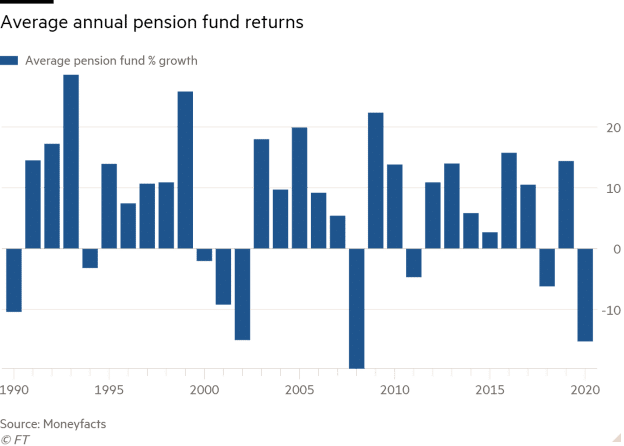

Clients are asking whether their retirement plans are being derailed

The coronavirus is having an impact on many pre-retirees who were hoping to retire early. According to UK newspaper The Telegraph millions of investors have had significant sums wiped off their pension pot. Legal & General estimated that more than 15 million workers over 50 would have to work an extra 3 years in order to have enough to retire on.

At this time advisors are playing a big part in how things pan out. Their advice is pivotal in ensuring clients are adequately protected - especially if they’ve historically been taking money from higher risk funds.According to some reports there’s been a big increase in requests for fixed term annuities. This is probably down to the fact that attitudes to risk have changed.

What you can do to increase your chances of success during the pandemic

1 If a client hasn’t been in touch call them

“Communicate, communicate and then communicate some more”

That’s according to Mark Casady, partner at Vestigo Ventures. “Customers want to know what their advisors think, and why,” “They want to experience their advisor’s confidence in the world returning to a more normal time. And small check-ins, like a simple message, count”

Despite performance blips the #number one reason clients are disappointed with their advisors is poor communication. They expect timely, reassuring and tailored communications.

If a client hasn’t gotten on the phone to you, call them and ask if you can help. Look out for your most vulnerable clients. The FCA has stated that FAs must identify their most vulnerable clients and ensure they are getting the support they need.

Key indicators of vulnerability include health, life events, resilience and financial capability. Look out for clients going through a divorce as well as those who’ve become recently unemployed. Check both they - and you - are confident their current financial plan is still fit for purpose.

3 Keep clients informed

The next few months are unlikely to be easy so re-visit client communication plans. Produce content to educate and reassure clients and keep them regularly updated about events.

4 Learn how to host the best client meetings

There are some things you can do to increase your chances of success, not least by making your virtual meetings with clients as productive as possible.

4 Make the most of your free time

If you have more time on your hands why not use it wisely to invest in training? You could consider gaining a specialist qualification on, say, pension transfers or long term care - or use this time to get the next level FA qualifications.

5 Move processes online

Make use of existing technology. As well as a CRM and financial planning tools make use of apps e.g. for admin or documentation processes to enable remote working both now and in the future.

If you step up your level of service, clients will remember you for helping them through uncertain times. When the current crisis is over they’ll look to you for help in rebuilding for the future and they will be more likely to refer you to family and friends as a trusted advisor.