I hope you get value out of this blog post.

How do you keep track of the important nuggets of information that you uncovered during a client meeting? When you promise to address a topic at the next meeting, how do you make sure you remember to put that topic on the agenda? Do you create tasks for yourself so that you’ll be reminded later? Do you keep it in an Excel file? Do you just keep it in your head and hope you don’t forget?

With Pulse360’s new tag feature, you can get rid of the endless calendar reminders and difficult to navigate Excel files. Tags keep your notes organized, your team on the same page, and ensure that you remember every follow-up, every agenda item for the next meeting, and every piece of value you created.

Below, I’ll talk more about why organization is so key to a successful financial advisory practice and how tags can help you and your team achieve that organization. Then, I’ll go over a couple use cases so you can see the new tag feature in action.

In his book, Getting Things Done, David Allen argues that an important step to getting focused and organized is developing a consistent system for keeping our thoughts and tasks in order.

When you’re juggling multiple clients, each with their own unique needs and circumstances, how do you develop a system for keeping all those different details unique to each client organized?

Financial advisors need a system that can handle the fast-paced nature of the advisory world; something that is adaptable to your practice and easy for your whole team to adopt. Above all, financial advisors need a system that is future proof and able to handle changes.

The first step to addressing all of these needs is a thorough and detailed notetaking system (as shared on Michael Kitces's blog by Michael Lecours of fpPATHFINDER). However, even with great notes, financial advisors still run into the problem of needing to sift through those notes in search of the particular piece of information they need for that next meeting or that follow-up email. Finding that needle in a haystack.

Like many of you, I have tried all sorts of technology and processes for bubbling up this information.

I’ve set up a dedicated Excel sheet where my team would diligently add notes to review prior to each meeting. This is a method many advisors use but, as many of us are aware, it’s not fail-proof.

I’ve used the task function of my calendar to set reminders for myself. However, these quickly mixed in with my other daily tasks and it just wasn’t a clean solution.

I’ve used planning software like eMoney, Naviplan, or MoneyGuide Pro which allow you to store these bits of information. However, not everyone in the practice uses the same software so that wasn’t an elegant solution either.

My most successful attempt at solving this problem was to attach keywords to my documents and then input them into a CRM like Redtail or Wealthbox. This way, I could pull up all my notes connected to a particular keyword.

However, even this was not a perfect solution.

Many times, the notes I added to the CRM were short-hand and lacked important context or details. More often, there were so many notes in a given document that it took up valuable time skimming through it all to find the relevant piece of information I actually needed.

This keyword system also wasn’t clear for everyone on my team. Only a select few knew what a particular keyword meant or how to apply them. The information is stored in such an individualized structure that it’s hard to get the whole team on the same page.

What I needed was a system that was easy to use, allowed for filtering of my notes to get straight to the relevant information quickly, and was clear and consistent enough that I could get my entire team to understand and use it.

I knew there had to be a better way to organize notes and capture information in a really granular way. Enter: tags.

With Pulse360, you can now tag specific pieces of information in your notes. When you’re setting your meeting agenda, compiling your annual summary, or just following up on a task, you can just search for that tag and pull up the specific line of information from your notes.

By applying keywords not just to whole documents but to individual pieces of information in those documents, you can quickly filter down specifically to the item you’re looking for.

Rather than being inundated with an overload of information unrelated to what you need, you can sift through only the individual notes that are tagged with the relevant keyword.

This simple yet elegant solution eliminated all those points of failure that I kept running into with the other solutions I tried before. Tags enable financial advisors to:

To better understand what makes this system easier and more effective than using an Excel sheet or a jumble of calendar reminders, let’s take a look at a couple examples:

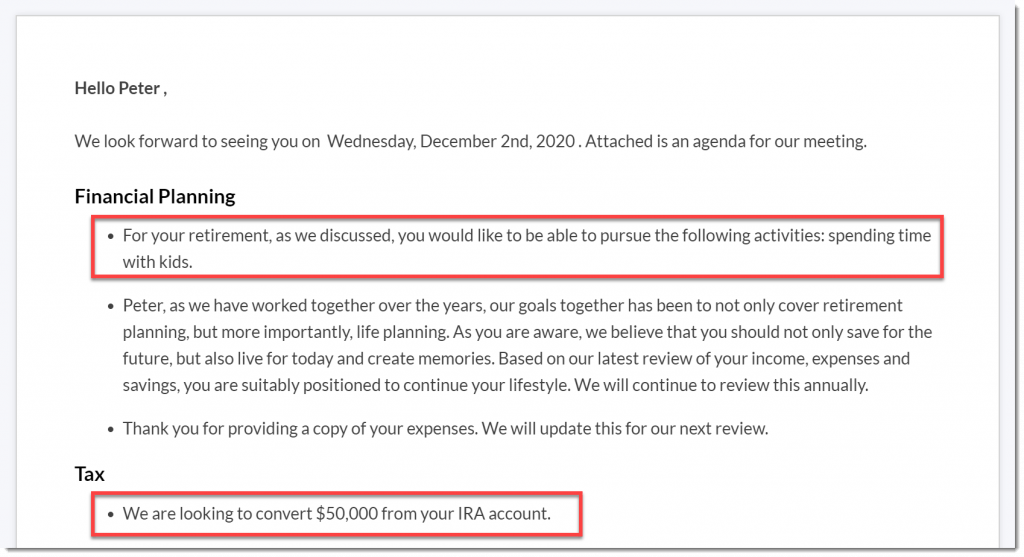

Retirement planning is a highly individualized and personal task. There are lots of pieces of information that you need to bring up at just the right time. For example, take the email below:

That IRA conversion will likely get addressed at the next meeting and probably be brought up again in the future. And what of the point about spending more time with kids? How do you prevent that detail from getting lost in the haystack?

The reality is that this type of information gets buried quickly. The more clients you have, the more difficult it will be to simply rely on your own memory. To run an efficient practice, you need a reliable system for pulling up that information easily so that both you and your team can refer to it at the right moments.

What if you needed to run a retirement scenario that excluded social security? What if your client mentioned wanting to build a casita in the back of their property when they retire? How do you remember to factor these details in when running that retirement scenario? How do you find every needle in the haystack?

You use tags. In this case, you could apply a tag called “planning cycle” to the specific items highlighted in red boxes in the screenshot above.

Now, when it’s time to run that retirement scenario, simply do a search for “planning cycle” and you’ll get a list of all the individual notes that have that tag.

During your next meeting about retirement plans with that client, search for the tag to pull up an easy to reference list of each note related to their unique goals.

Your client’s investment policy is another highly personalized aspect of their financial goals that goes beyond their general risk and return profiles. However, it’s not always practical to read through their entire IPS each time it’s time to talk about investments or generate cash.

For example, say a client has a particular pet stock, one that they favor and would not consider selling.

When it comes time to generate cash, you need to make sure that neither you nor your staff recommend selling that stock. Doing so would give your client the impression that you aren’t really listening to them or prioritizing their preferences.

By applying the tag “IPS”, you or your staff can pull up all the relevant pieces of information related to that client’s unique IPS and, thus, avoid making unusable trade recommendations.

When you’re heading into a meeting with this client about their investments, you can pull up the “IPS” tag for a quick reference of all your relevant notes from previous meetings. You don’t need to read through the entire IPS.

The advantage of tags is that they can be applied to individual granular notes, rather than just whole documents. You can focus in on the specific detail you need rather than having to weed through 10 other things that you don’t.

Once you define your set of tags, you can teach them to your team and make sure everyone is applying them to individual notes in each document.

Here are some examples of tags you might use:

A “soft point” tag can label personal goals that are indirectly related to their financial plans. It would have been helpful in the first case above, for the note about the client’s desire to spend more time with their kids.

A “future meeting” tag can be used to quickly identify points that need to be addressed at your next meeting with that client.

The “value” tag can help you quickly identify each piece of advice you gave that created value for that client.

I’m so excited about this new individual note tagging capability we’ve introduced to our software! While tagging full documents has been possible for a while, I’ve now applied this to the financially advisory world in a way that makes it possible to track single pieces of your notes.

With tags, you can now feel confident that no detail will fall through the cracks. It’s easy to use, scalable to your practice, and doesn’t require constant training of your team.

To learn more about how Pulse360 tags can improve your workflow, schedule your demo today!