I hope you get value out of this blog post.

Forgetting information we learned is a natural part of life. However, as financial advisors, this process can make it difficult for clients to keep track of the topics discussed and the recommendations we provided. Without that memory of our financial advice, clients will struggle to realize just how much value we’ve created for them.

In this post, I’ll talk more about what the forgetting curve is, how it affects your relationship with clients, and how you can disrupt the process and better communicate your value to your clients.

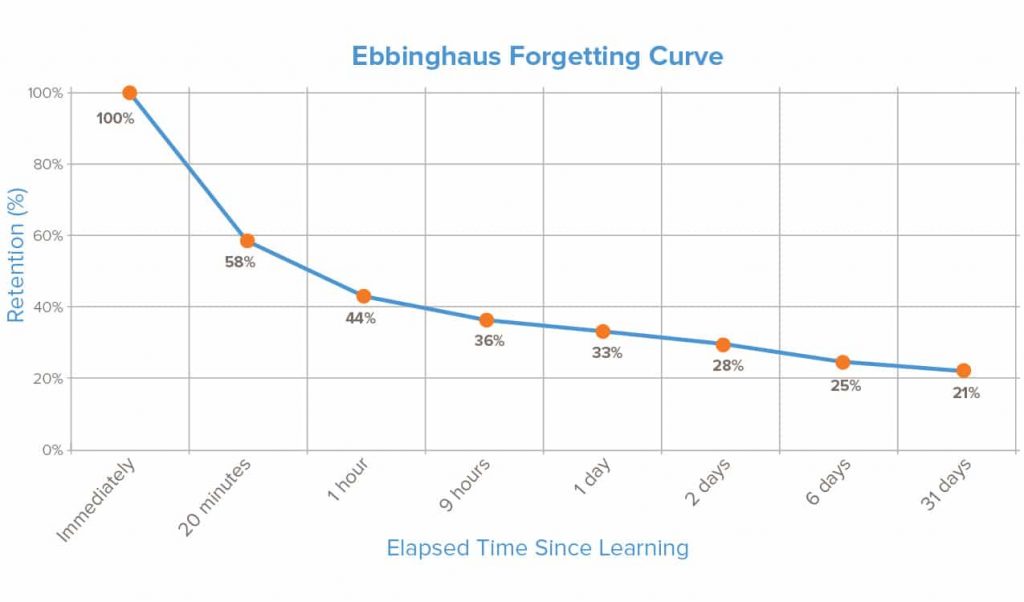

The forgetting curve is a psychological phenomenon identified by Hermann Ebbinghaus and is sometimes referred to as the Ebbinghaus Forgetting Curve. It refers to the rate at which our brain loses learned information. The curve looks like this:

People forget more than 50% of what they learned within an hour of learning it. While this is natural, the process can be disrupted. This is why learning something new requires a combination of diligent note-taking and repeated review of the material.

I’ll talk more about how you can disrupt the forgetting curve process for your clients later on in this post.

The less familiar someone is with the information they were told, the faster this forgetting curve happens. So, when you throw complex financial topics into the mix, your clients are likely to forget most of what you discussed during a meeting within an hour of walking out the door.

As a financial advisor, your job is to educate your clients on their different options and providing expert financial advice. While many of us do an excellent job of this during the meeting itself, we’re fighting a losing battle if we don’t make a habit of following up afterward.

This is even more important with quiet clients. The more someone actively participates in a conversation, the more they’ll remember of that conversation. With naturally quiet clients, that limited participation will worsen the forgetting curve effect.

As I’ve discussed in other posts, financial advisors who do not provide structure to their conversations with clients are really losing out on the value conversation. I have witnessed this forgetting curve firsthand with clients so I know how much of an impact it can have on how clients understand the value we create.

The more the client forgets, the harder it will be for them to identify the value you provide. Simply put, if they don’t remember the information you provided or the advice you gave, they won’t remember how valuable that meeting was.

The most common complaints that clients have about their financial advisor include:

These client complaints can take months, if not years, to resolve. That takes time and energy away from your work and hurts your relationships with clients. Many of these common complaints that financial advisors deal with could be avoided altogether with the proper follow-up strategy in place.

So, how do you disrupt this process and make sure clients feel more confident in the education and recommendations they get from you? Above all, you should be providing written summaries of the key points brought up during the meeting.

A written summary of each meeting will help minimize the effect of the forgetting curve and achieve the following:

Given how important a written summary is for ensuring that your client remembers the advice and information you gave along with the value you created, it’s worth doing it right. Make sure your follow-up process is built around these three steps:

You’re human, too! You may not forget quite as quickly as your client since financial topics are your expertise and you probably have a written agenda of what you planned to discuss during the meeting. However, you’re still at risk of forgetting the specifics, any unplanned items that came up, and other key details of the meeting.

While you can’t always take detailed notes during the meeting, you should do so immediately after while it's still fresh in your mind. Even if you don’t have time right this second to write out a full summary for your client, good note documentation now will make it so much quicker to create that summary later when you do have time.

As you saw in the graph above, over half of learned information is gone just an hour later. So, send that written summary within the hour if possible and by the end of the day at the latest. Prompt follow-up not only helps your client remember your advice but also makes that client feel like a high priority.

With Pulse360, sending out summaries is made systematic and stream-lined. By keeping your notes all in one place and using our tools, you can create full, ready-to-email summaries in minutes.

You can provide the follow-up attention your clients need in order to remember your advice—and, therefore, your value—without taking hours out of each day to write up summaries for every meeting.

This recent feedback from an advisor shows how clients value strong follow up notes:

The forgetting curve process poses a challenge to financial advisors whose bread and butter is the valuable financial advice we provide to our clients. So taking steps to disrupt that process and ensure your clients actually remember that advice is one of the best things you can do to make sure the value you create is clear and understood at all times.

Forgetting information we learned is a natural part of life. However, as financial advisors, this process can make it difficult for clients to keep track of the topics discussed and the recommendations we provided. Without that memory of our financial advice, clients will struggle to realize just how much value we’ve created for them.

In this post, I’ll talk more about what the forgetting curve is, how it affects your relationship with clients, and how you can disrupt the process and better communicate your value to your clients.