I hope you get value out of this blog post.

Did you know that according to a study, shared values are a significant factor in building relationships between customers and brands?

As a financial advisor, purpose-driven marketing can be your key to unlocking deeper connections with your clients.

Purpose-driven marketing represents a paradigm shift in the way financial advisors and coaches approach their marketing strategies.

It's not just about promoting services and products — it's about connecting your core values and mission with your target audience in a meaningful way.

At its core, purpose-driven marketing is about aligning your business's marketing efforts with a cause or set of values that are significant to both you and your clients.

When you think about it, it’s actually a strategy that focuses on the 'why' behind what you do, rather than just the 'what' and 'how'.

For financial advisors, this could mean emphasizing your commitment to:

? Difference from Traditional Marketing Approaches

Traditional marketing in the financial advisory industry often centers around showcasing expertise, services, and performance metrics.

While these elements are undeniably important, purpose-driven marketing goes a step further:

It’s about telling a brand story that emotionally connects, showing you're more than a service provider, but a partner who shares your clients' values and goals.

This marketing humanizes your brand, making it relatable to clients who want more than financial advice — they seek an advisor who aligns with their worldview.

Your brand's purpose acts as the compass for all your marketing efforts, influencing how clients perceive your brand.

This purpose is often rooted in your core values and the unique approach you take in the financial advisory space.

For instance:

If your purpose revolves around empowering small businesses with financial literacy, your brand identity will likely be perceived as supportive, knowledgeable, and community-focused.

This perception is important in distinguishing your brand in a crowded market and in earning long-term benefits for loyalty and trust.

? Long-Term Benefits for Brand Loyalty and Trust

Purpose-driven marketing fosters deeper connections with clients, leading to enhanced brand loyalty and trust.

When clients believe in your brand's purpose, they are more likely to develop a strong, emotional connection with your brand.

This connection goes beyond the typical client-service provider relationship, fostering a sense of partnership and mutual understanding.

Over time, this can translate into a more loyal client base, more enthusiastic referrals, and a stronger overall reputation in the financial advisory community.

Implementing purpose-driven marketing requires a strategic approach to ensure that your purpose resonates through every aspect of your marketing efforts.

For financial advisors, this means creating a marketing plan that not only showcases your services but also aligns with your core values and the values of your target clients.

The first and perhaps most critical step in implementing purpose-driven marketing is to identify the core purpose of your financial advisory practice.

This purpose should be the guiding light for all your marketing strategies and client interactions:

Start by introspecting on what you stand for and what you believe in:

For example, your purpose might be rooted in:

Your purpose should not only resonate with you but also address the needs and expectations of your target market.

Conduct market research to understand the challenges, desires, and values of your potential clients.

This step is important in ensuring that your identified purpose aligns with the interests of those you aim to serve.

Once you have a clear understanding of your core values and the market's needs, articulate your purpose in a concise statement.

This statement should encapsulate what you stand for and how it benefits your clients. For instance, a purpose statement like:

“Empowering small businesses to navigate financial complexities with confidence and clarity” succinctly conveys a commitment to serving a specific client segment with specialized expertise.

Once you have identified your purpose, the next important step is to align this purpose with the values and needs of your clients.

This alignment is essential in creating marketing strategies that resonate deeply with your target audience, fostering a sense of shared goals and values.

Begin by thoroughly understanding who your clients are.

This involves delving into not just their financial needs but also their demographics (age, income level, occupation, etc.) and psychographics (values, interests, lifestyle, etc.).

For instance, if your purpose is centered around ethical investing, ensure that your client base values sustainability and corporate responsibility.

Tools like surveys, interviews, and market research can be invaluable in gaining these insights.

Once you have a clear picture of your clients' values, tailor your services and marketing messages to echo these values.

If your clients value transparency and education in financial planning, your services should reflect this by offering clear, straightforward advice and educational resources.

Similarly, your marketing messages should consistently communicate how your services align with these values.

One of the most effective ways to align your purpose with your clients' values is to create a sense of community.

This can be done through social media groups, workshops, webinars, or client events centered around common interests or goals.

For example, if your purpose involves financial literacy, hosting educational workshops or online forums can be an excellent way to engage with clients and reinforce shared values.

Remember that clients who share your values are more likely to engage deeply with your services, remain loyal over time, and become advocates for your brand.

Effectively communicating your purpose is critical in purpose-driven marketing.

This step is about ensuring that your identified purpose and aligned values are clearly and consistently conveyed to your target audience.

Here’s how you can achieve this:

To effectively communicate your purpose, it's essential to use the right channels. These channels should be where your target clients are most active and receptive.

For financial advisors, this could include professional networking sites like LinkedIn, financial forums, email newsletters, and even local community events.

The key is to choose platforms that resonate with your clientele and where your messages will be most impactful.

The messages you convey should reflect your purpose authentically.

This means using language and tones that resonate with your audience while staying true to your core values.

Your messaging should consistently reinforce your purpose, whether it's in your advertising, content marketing, social media posts, or direct client communications.

For instance:

If your purpose revolves around personalized financial planning, your communications should emphasize your individualized approach and the benefits it brings to clients.

Showcasing real-life examples or case studies where your purpose-driven approach made a significant difference in a client's financial journey can be incredibly powerful.

This not only provides tangible proof of your purpose in action but also helps potential clients envision the benefits of working with you.

Share these stories on your website, in client meetings, or as part of your content marketing strategy.

Measuring the impact of purpose-driven marketing is important to understand its effectiveness and to make necessary adjustments for improvement.

This process involves tracking key performance indicators and using specific tools and techniques to measure the impact of your purpose-driven marketing efforts.

Key performance indicators are quantifiable measures used to gauge the success of marketing initiatives.

For purpose-driven marketing, these KPIs need to reflect not only financial outcomes but also how well your purpose resonates with your audience.

Here are the indicators important in purpose-drive marketing:

One of the most telling indicators of successful purpose-driven marketing is a high client retention rate.

Clients who feel a strong alignment with your purpose are more likely to remain loyal. Additionally, monitor the rate at which existing clients refer new clients to you.

A high referral rate often suggests that your clients are advocates of your brand, which is a direct outcome of effective purpose-driven marketing.

Measure the level of awareness and the reputation of your brand among your target audience.

This can be done through brand recall surveys, monitoring mentions on social media and analyzing engagement on content related to your purpose.

A positive shift in brand awareness and reputation is a strong indicator that your purpose-driven message is resonating with the audience.

Track the engagement and response rates of your marketing campaigns, especially those that explicitly convey your purpose.

High engagement rates on such content (shares, comments, or click-through rates on newsletters) indicate that your message is striking a chord with your audience.

Regularly collect feedback from your clients to understand how they perceive your brand and whether they feel aligned with your purpose.

Satisfaction scores, through surveys or direct feedback, can provide valuable insights into how effectively your purpose-driven approach is being received.

To accurately assess the effectiveness of purpose-driven marketing strategies, financial advisors need to use a variety of tools and techniques.

These resources help in gathering data, analyzing trends, and providing actionable insights for future marketing endeavors.

Here are some key tools and techniques that can be utilized:

| Tools | Description | Examples |

| Digital analytics platforms | Essential for tracking online engagement, providing insights into website traffic, user behavior, and more. | Google Analytics, Adobe Analytics |

| Social media analytics | Offers data on engagement, reach, and audience demographics on social media platforms. | Hootsuite, Sprout Social, LinkedIn Analytics |

| Client relationship management | Tracks client interactions, referrals, and retention rates, and helps in client segmentation. | CRM Software |

| Survey and feedback tools | Used for gathering direct client feedback to assess satisfaction, brand perception, and communication. | SurveyMonkey, Google Forms |

| Content analysis tools | Analyzes content marketing performance, identifies resonating topics, and measures reach and competition. | BuzzSumo, SEMrush |

| ROI calculation methods | Important for understanding financial and indirect returns on marketing efforts. | ROI Calculation |

| Competitor benchmarking | Provides context by analyzing competitors' purpose-driven marketing efforts and market position. | Alexa, SimilarWeb |

By using these tools and techniques, you can gain a comprehensive understanding of how your purpose-driven marketing efforts are performing.

This insight is important for refining strategies, enhancing client engagement, and ultimately driving business growth.

Remember that purpose-driven marketing is a dynamic process.

It requires ongoing attention, reflection, and adaptation. Keep your finger on the pulse of your clients' evolving values and be prepared to iterate on your approach as necessary.

By doing so, you will not only cultivate deeper relationships with your clients but also build a brand that stands the test of time, marked by integrity, impact, and a clear vision for the future.

Let your purpose attract, engage, and retain clients, and watch as it transforms not just your marketing, but the very essence of your advisory practice.

As a financial advisor, you understand the importance of purpose-driven marketing in establishing strong client relationships and a resonant brand identity.

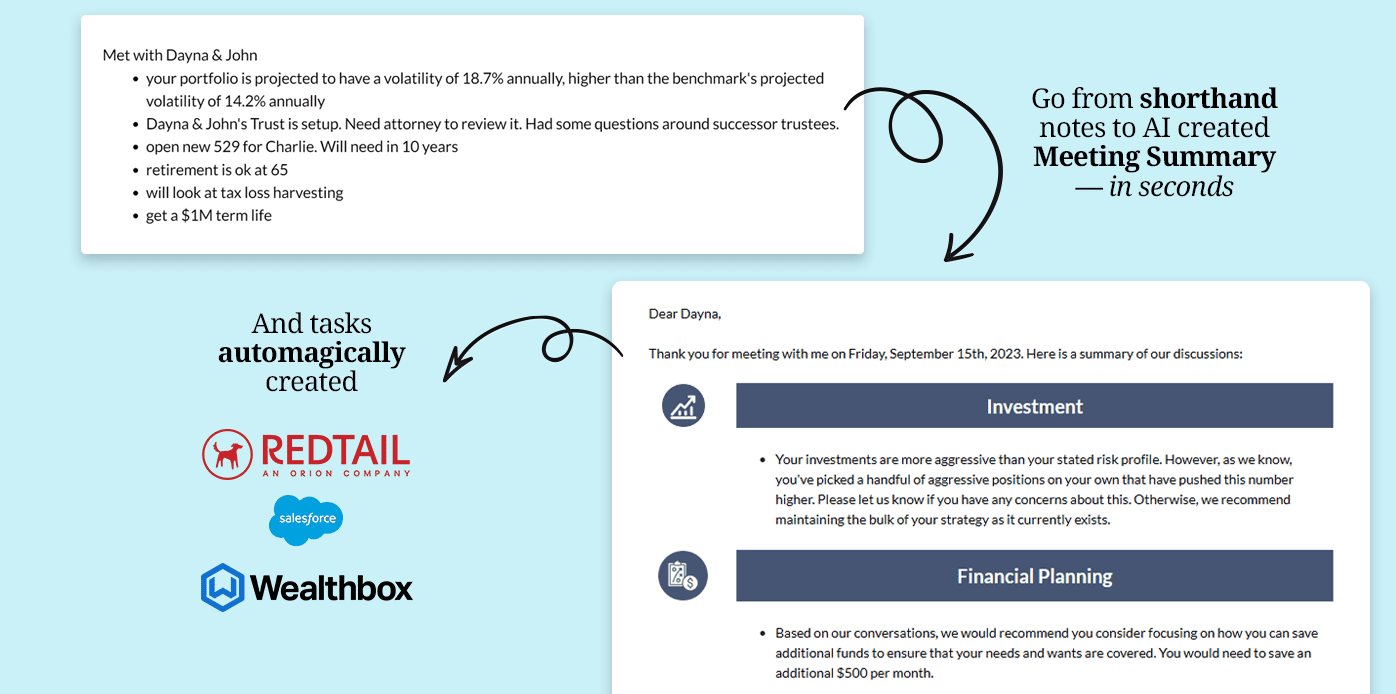

But, to truly elevate your practice, the right tools are just as important as the right strategy — this is where Pulse360 comes into play.

With plans tailored to every need:

In purpose-driven marketing, it’s not just what you say, it’s also how you say it.

Let Pulse360 be the voice of your brand, ensuring your purpose is communicated effectively and efficiently.