I hope you get value out of this blog post.

Did you know that a notable 64% of Americans report feeling anxious or stressed about money?

This statistic has been underscored by multiple surveys, including the 2022 Policygenius Financial Anxiety Survey, which revealed that 64% of Americans are feeling anxious about their finances over the next 12 months.

If you're a financial advisor or coach, understanding and navigating your clients' financial anxieties is more crucial now than ever.

Are you fully aware of the signs and underlying psychology that indicate your client is anxious about their financial future?

Understanding client anxiety is the cornerstone of effective financial advising and coaching.

It's not just about recognizing behavioral cues or listening to verbal concerns — it's about digging deeper into the psychology that fuels these anxieties.

This foundation enables you to offer not just financial solutions, but emotional relief as well.

Understanding the psychology behind anxiety is crucial for financial advisors and coaches aiming to guide their clients through periods of change.

Knowing what triggers anxiety can enable you to address it effectively and provide solutions that resonate with your clients on a personal level.

? Why do people fear change?

At its core, anxiety is a fear-based emotion.

Humans are wired to seek stability — it's a survival instinct. Change disrupts this sense of stability, which can trigger the body's "fight or flight" response.

This ancient mechanism kicks in when we perceive a potential threat, flooding our system with stress hormones like adrenaline.

In a financial context, this could mean a volatile market, a career change, or even retirement—all of which bring about uncertainty.

One of the key psychological factors at play is uncertainty.

People like predictability: it makes them feel in control. When faced with change, this sense of control is challenged, leading to anxiety.

In financial settings, uncertainty can be even more daunting due to another psychological principle: loss aversion.

Simply put, the pain of losing is psychologically about twice as powerful as the pleasure of gaining. So, the prospect of financial loss can be a significant stressor for your clients.

? The role of cognitive biases

Your clients' perception of change and risk is also influenced by various cognitive biases.

For instance, the "recency bias" might make them overly concerned about current market events, ignoring long-term trends.

Understanding these biases can help you communicate more effectively with your clients, correcting misconceptions and providing a balanced perspective.

It's important to remember that, for many people, their financial portfolio is not just a collection of numbers:

It’s years of hard work, a retirement dream, or a legacy they wish to leave behind.

When you understand that there's an emotional investment as well, you're better equipped to handle their anxieties and guide them through financial decisions.

Recognizing the signs of anxiety in your clients is the first step in offering targeted support and guidance.

While everyone's experience of anxiety varies, there are common behavioral and verbal cues that can alert you to a client's emotional state.

Here are some behavioral cues to watch out for:

Recognizing behavioral cues is just the first piece of the puzzle.

These nonverbal signs give you an initial glimpse into your client's emotional state. However, understanding anxiety fully requires you to tune into what your clients are saying.

The language they use can offer further insights into their anxieties, giving you a more complete picture and enabling you to address their concerns more effectively.

Now, let's explore the verbal cues that can signal a client's anxiety:

Identifying these signs of anxiety early on can proactively address your clients' concerns before they escalate.

This allows you to guide the conversation towards constructive solutions and helps you tailor your communication to alleviate their specific anxieties.

As a result, you will be fostering a relationship built on trust and understanding, which are key components in helping your clients navigate through financial changes with confidence.

? Related: 5 Tips for Building Trust with Your Clients

You've identified signs and explored the psychology behind your clients' financial worries.

But what actionable steps can you take to alleviate these concerns?

The answer lies in a multi-faceted strategy that goes beyond mere financial advising:

Crafting a tailored financial plan is one of the most effective ways to alleviate your clients' anxiety:

A well-thought-out plan serves as a roadmap, providing a sense of direction and a measure of control, both of which can be powerful antidotes to anxiety.

A one-size-fits-all approach seldom works when it comes to financial planning, especially for clients who are already anxious about their financial future.

Each client's financial situation, risk tolerance, and life goals are unique. Addressing these individual factors in a customized plan can significantly ease their mind.

According to a study by Northwestern Mutual:

84% of wealthy individuals have a long-term financial plan that accounts for economic fluctuations, compared to 52% among the general population.

This significant disparity highlights the peace of mind and preparedness that comes with having a structured financial roadmap, especially in facing economic uncertainties

In regards to creating a tailored financial plan, it shouldn’t just be a static document — it should include actionable steps that the client can take.

Here’s a table of action steps that you can include:

| Action Step | Description |

| Initial Consultation | Schedule a one-on-one meeting with the client to understand their financial goals, fears, and current situation. |

| Risk Assessment | Conduct a risk tolerance questionnaire or interview to evaluate their willingness and ability to take on financial risks. |

| Data Gathering | Collect essential financial data such as income, expenses, assets, and liabilities. Use secure methods for data storage and analysis. |

| Draft an Initial Plan | Create a preliminary financial plan based on the gathered data and risk assessment. Include various investment options and financial products suitable for the client. |

| Client Review | Present the initial plan to the client for feedback. Discuss the pros and cons of various options to gauge their comfort level. |

| Incorporate Feedback | Make necessary changes to the plan based on the client's feedback. Fine-tune investment strategies, savings plans, and other elements. |

| Fact-Based Assurance | Share relevant statistics or studies that support the strategies in the plan, reinforcing the psychological benefits. |

| Set Actionable Goals | Break down the plan into smaller, achievable milestones. Offer a timeline for these goals to give the client a sense of control. |

| Finalize the Plan | Once the client approves, finalize the tailored financial plan. Provide them with a detailed document outlining the agreed-upon strategies and goals. |

| Ongoing Review and Adaptation | Schedule regular check-ins to review the plan's progress. Make adjustments based on market changes, life events, or shifts in client comfort levels. |

Remember that financial plans are not set in stone; they must be reviewed and adapted regularly.

Make sure your clients know this, as it allows for flexibility and adjustments based on life changes or market conditions.

This adaptability can also be comforting to an anxious client, knowing that their plan is not rigid but is, in fact, a living document that evolves with them.

One of the most effective ways to combat anxiety is through education.

When clients understand the financial landscape, the strategies being employed, and the reasons behind certain decisions, they are far more likely to feel in control.

This sense of control can significantly reduce their anxiety levels.

Education is an ongoing process.

While it's important to provide resources, it's equally crucial to know when to introduce these educational materials.

Here's a compelling fact to consider:

Various studies have highlighted the potential for financial literacy to modulate risk aversion among investors.

For instance, one study recommends enhancing financial literacy to help overcome behavioral biases like risk aversion.

This suggests that education not only empowers clients but also assists in making them more comfortable with the inherent risks of financial planning.

As a financial advisor or coach, your role includes curating information so that it's relevant, accurate, and understandable for your clients.

Here are the resources to offer:

Remember that education is a two-way street. Encourage your clients to ask questions and share their concerns.

Not only does this provide them with clarity, but it also gives you insights into what worries them the most, allowing you to address those specific issues effectively.

? Related: 6 Questions for Financial Advisors to Ask Clients to Build Trust and Loyalty

Consistent communication is vital in any advisor-client relationship, but it becomes even more crucial when your clients are anxious about their financial future.

Consistency is key when it comes to easing anxiety:

A consistent communication schedule helps to set expectations and creates a routine that clients can rely on.

It assures them that you're closely monitoring their financial situation, and this in itself can be a great comfort.

A survey conducted by Coleman Parkes Research on behalf of Advisor360° highlighted the desire among high-net-worth individuals for more engagement with their financial advisors.

While the exact percentage regarding response expectations within a few hours wasn't provided, this insight emphasizes the value clients place on timely communication.

Your clientele's preferences may vary, yet regular updates and check-ins remain a crucial strategy to ease anxiety, especially when navigating through changes.

Here’s a table of the suggested items to include in updates:

| What to Include | Description |

| Market Overview | Provide a brief summary of current market trends and how they could impact the client's portfolio. |

| Personalized Insights | Update the client on the performance of their specific investments and any changes you recommend in the financial strategy. |

| Upcoming Events | Inform clients about any significant financial events, deadlines, or opportunities that may affect their portfolio. |

| Action Items | List any immediate steps or decisions that the client needs to make, giving them a clear path for action. |

In addition to regular updates:

Scheduled check-in meetings (either face-to-face or virtual) provide an excellent opportunity to delve deeper into the financial plan, address any concerns, and reassess goals and strategies.

These meetings serve as a dedicated space for you and your clients to engage in a meaningful dialogue about their financial well-being.

Scenario planning is an incredibly useful tool for helping clients deal with anxiety related to financial change.

By walking them through various "what-if" scenarios, you equip them to face the unknown with a sense of preparedness and resilience.

This is a strategic way to turn fear of the unknown into an actionable plan:

The power of scenario planning lies in its ability to make abstract fears more concrete.

Instead of grappling with vague anxieties about market downturns or investment risks, clients can see the tangible outcomes of various scenarios.

Here are the types of scenarios to explore:

If you haven’t tried it yet, I prepared an example of a what-if scenario:

| Element | Scenario Details |

| Scenario Name | Impact of a Market Downturn |

| Objective | To assess how a 10% market downturn would affect the client's portfolio |

| Assumptions | - 10% decline in stock market value - No changes in fixed-income assets - No additional contributions during a downturn |

| Potential Impact | - 15% decrease in portfolio value - Delay in reaching short-term financial goals by 6 months |

| Recommended Actions | - Diversify asset allocation to include more low-risk investments - Review and adjust spending plans |

| Probability of Occurrence | 20% (Based on historical data and current market conditions) |

Scenario planning is not a one-time event but an ongoing process.

As economic conditions change or personal circumstances evolve, new scenarios may arise that warrant consideration.

Make sure your clients understand this fluid aspect of financial planning.

One of the most empowering things you can do for anxious clients is to offer them multiple options for their financial planning.

The sense of having choices can mitigate feelings of being trapped or cornered, which often accompany financial anxiety.

When clients feel like active participants in their financial journey, rather than just spectators, their confidence grows.

Choice is intrinsically linked to a sense of control.

When people feel they have options, it enhances their perception of control over a situation, reducing stress and anxiety.

For clients who are anxious about financial changes or decisions, having options can be a significant relief.

Here are some types of options to present:

But how should you present those options?

After all, presenting multiple options in a structured format helps clients make informed decisions and eases their financial anxiety.

Here are some of my suggestions:

| Element | Presentation Details |

| Option Name | Diversified Mutual Fund, Corporate Bond, Real Estate Investment |

| Risk Level | Moderate for Diversified Mutual Fund, Low for Corporate Bond, High for Real Estate Investment |

| Potential Returns | 7-10% for Diversified Mutual Fund, 3-5% for Corporate Bond, 8-12% for Real Estate Investment |

| Time Horizon | Long-term for Diversified Mutual Fund, Mid-term for Corporate Bond, Long-term for Real Estate Investment |

| Liquidity | High for Diversified Mutual Fund, Moderate for Corporate Bond, Low for Real Estate Investment |

| Pros and Cons | - Mutual Fund: Diversification but management fees - Corporate Bond: Stable but lower returns - Real Estate: High returns but illiquid and high initial investment |

| Advisor's Recommendation | Based on your risk tolerance and financial goals, the Diversified Mutual Fund seems to be the best fit. |

Offering choices comes with the responsibility of guiding your clients through the decision-making process.

Use your expertise to help them weigh the options and arrive at a decision that they're comfortable with.

In navigating the labyrinth of financial uncertainties, a lot of people grapple with anxiety and stress, underscoring the indispensable role of financial advisors.

Financial advisors must dive into the psychology of money worries and anxiety-easing strategies, offering both financial guidance and essential emotional support to their clients.

This holistic approach fosters a climate of trust, empowers clients to make informed decisions, and ushers in a journey toward financial serenity amidst the ever-evolving economic landscape.

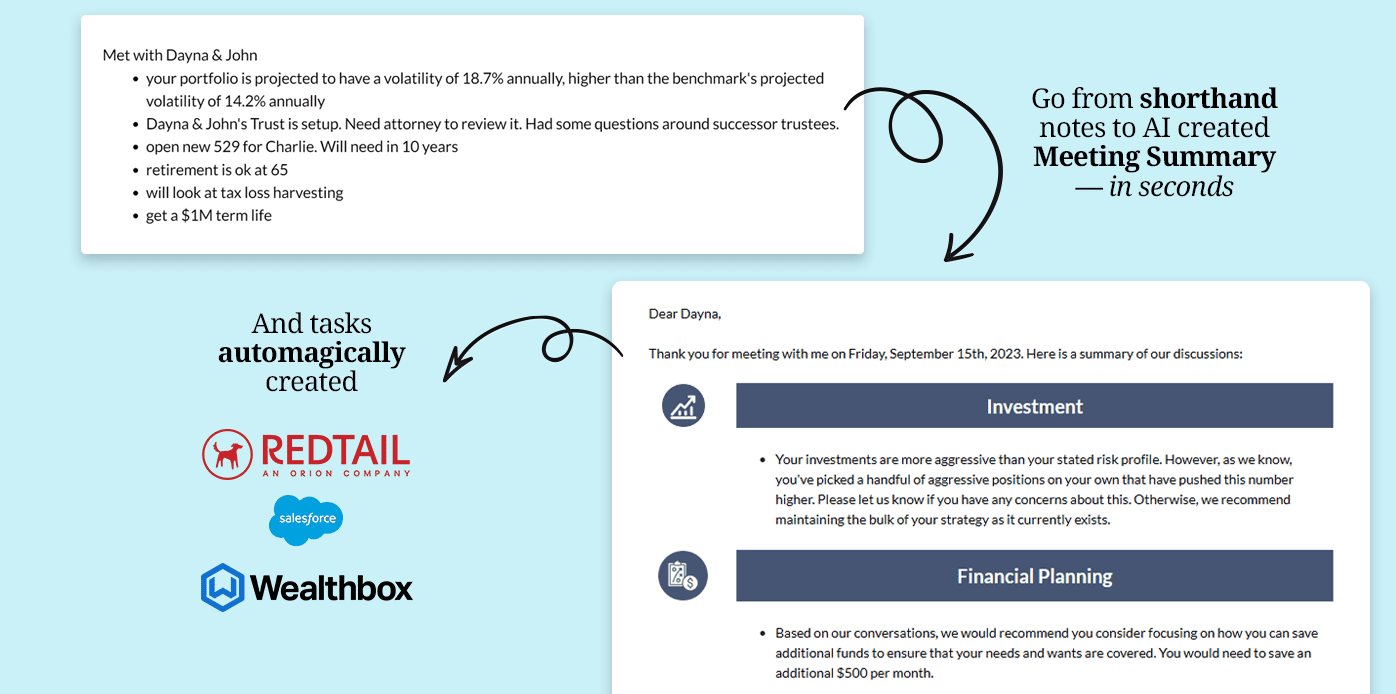

You grasp the significance of identifying and alleviating your clients' financial anxieties. But what about the tools for greater efficiency?

Mastering behavioral finance and client psychology requires more than expertise; it requires the right technology. That's where Pulse360 comes into play.

With plans tailored to every need:

Don't let the burden of manual documentation hamper your ability to address client anxieties.

Elevate your practice and win your clients' trust with Pulse360.