I hope you get value out of this blog post.

How can you ensure your clients place their trust in you?

The CFA Institute's latest findings are telling:

86% of institutional investors and 60% of retail investors highly trust financial services, driven by personalization and technology.

In a world where nearly three-quarters of millennial investors show a strong trust in financial services, setting your business apart means tapping into these pivotal trust factors.

With the financial advisory industry today, standing out is not just a luxury — it's a necessity.

The question, however, remains:

Can differentiation truly make a difference in such a saturated market? The answer is a resounding yes.

Differentiation, when executed strategically, can be the deciding factor that sets your financial advisory business apart from the competition.

? Related: Why you need a unique value proposition and how to create one?

It's important to distinguish yourself from your competitors.

This requires more than just offering standard services — it involves creating a unique brand identity and client experience.

Here are key strategies to help you stand out:

Specializing in a niche market means focusing your financial advisory services on a specific segment of the market.

This approach involves targeting a particular type of client, industry, or area of financial planning.

By doing so, you become a specialist rather than a generalist, offering in-depth knowledge and tailored services that address the unique needs of your chosen niche.

? Example:

For instance, consider a financial advisor who specializes in serving healthcare professionals. This advisor would have a deep understanding of the financial challenges and opportunities specific to doctors, nurses, and other healthcare workers, such as managing student debt, navigating unique tax situations, or planning for irregular income patterns.

How to create a niche market strategy:

By specializing in a niche market, you not only set yourself apart from the competition but also add more value to your clients.

This specialization fosters stronger client connections, boosts credibility, and often leads to more referrals in your niche, fueling your financial advisory business's success.

Here’s what providing exceptional client service in the financial advisory sector means:

Going beyond basic financial guidance and offering a client experience that is personalized, attentive, and exceeds expectations.

This level of service fosters strong, lasting relationships and can significantly differentiate your business in a crowded market.

? Example:

Exceptional client service is about understanding and anticipating your clients' needs. For example, consider a financial advisor who not only provides personalized investment strategies but also takes the time to educate their clients on financial literacy, offers regular check-ins to adjust financial plans as life changes, and is always available to answer questions or address concerns.

Here are strategies to deliver exceptional client service:

By providing exceptional client service, you not only retain clients but also turn them into advocates for your business.

Happy clients are more likely to refer others, helping to grow your business organically.

This approach to service also establishes a strong reputation and trust, which are invaluable assets in the financial advisory industry.

Establishing authority in the financial advisory industry means positioning yourself as a knowledgeable and trustworthy expert in your field.

This status is achieved through demonstrating expertise, sharing insights, and gaining recognition from both clients and peers.

Being seen as an authority not only helps in attracting clients but also in building long-term credibility and influence.

? Example:

For instance, imagine a financial advisor who is frequently quoted in reputable financial publications, regularly publishes insightful articles on market trends, and is often invited as a speaker at industry conferences. This advisor is viewed as an authority figure, someone whose opinions and insights are respected and sought after.

How to establish yourself as an authority:

By becoming an authority in the financial advisory industry, you boost your professional standing and build trust with both current and potential clients.

This reputation as a trusted expert is invaluable in growing and sustaining a successful financial advisory business.

Forming strategic partnerships in the financial advisory field involves:

Collaborating with other businesses or professionals to offer enhanced services, reach broader audiences, and achieve mutual business goals.

These partnerships can be with individuals or organizations whose services complement your own, allowing for a synergy that benefits both parties and, most importantly, the clients.

? Example:

For example, a financial advisor might form a partnership with a legal firm specializing in estate planning. This relationship allows the advisor to offer comprehensive financial and legal planning services to clients, adding value and expanding the range of services available to them. The legal firm, in turn, gains access to clients who may need estate planning services, creating a mutually beneficial arrangement.

Here's how to form strategic partnerships:

Strategic partnerships can significantly expand the range and quality of services you offer, helping your financial advisory business to stand out.

These collaborations not only provide clients with a more comprehensive service package but also facilitate business growth through cross-promotion and expanded professional networks.

Customizing your services to client needs in the financial advisory sector means:

Tailoring your advice, strategies, and solutions to fit the unique financial situations, goals, and preferences of each client.

This approach goes beyond generic advice, focusing on creating personalized plans that align closely with the individual circumstances of each client.

? Example:

Consider a scenario where a financial advisor works with a diverse range of clients, including young professionals just starting their careers, families planning for their children's education, and retirees managing their post-retirement finances. The advisor takes the time to understand each client’s financial situation, goals, and risk tolerance, and then creates customized investment strategies and financial plans for each. For the young professional, this might mean a focus on long-term growth and student loan management, while for the retiree, it could be more about income generation and capital preservation.

Here's how to customize your services:

Customizing your services not only demonstrates your commitment to addressing individual client requirements but also helps in building stronger, more trusting client relationships.

This personalized approach is likely to lead to higher client satisfaction, retention, and referrals, contributing to the growth and success of your advisory practice.

Offering fee transparency in the financial advisory industry means being open and clear about the fees clients are charged for your services.

This approach involves providing detailed explanations of all fees, including how they are calculated, what services they cover, and why they are necessary.

Fee transparency is important for building trust and long-term relationships with clients, as it eliminates confusion and potential mistrust that could arise from hidden or unexpected costs.

? Example:

Imagine a financial advisor who clearly outlines their fee structure on their website and in initial consultations. They explain to clients that they charge a percentage-based fee on the assets under management, a fixed fee for financial planning services, or a combination of both, depending on the client's preference and the complexity of their financial situation. The advisor also ensures that any additional costs, like transaction fees or expenses related to specific investment products, are disclosed upfront.

Here's how to offer transparent fees:

Offering fee transparency is more than just a best practice — it’s an important element of client trust and satisfaction in the financial advisory sector.

Transparent fees empower clients, strengthen advisor-client relationships, and boost your advisory practice's reputation.

Standing out in the financial advisory market hinges on more than unique services, it's about crafting a client experience that's personalized, trustworthy, and expertly informed.

These strategies are key to building lasting client relationships and a reputation as a trusted advisor, steering your business toward enduring success and growth.

Understanding your clients' unique financial landscapes is crucial, but so is managing the administrative aspects efficiently.

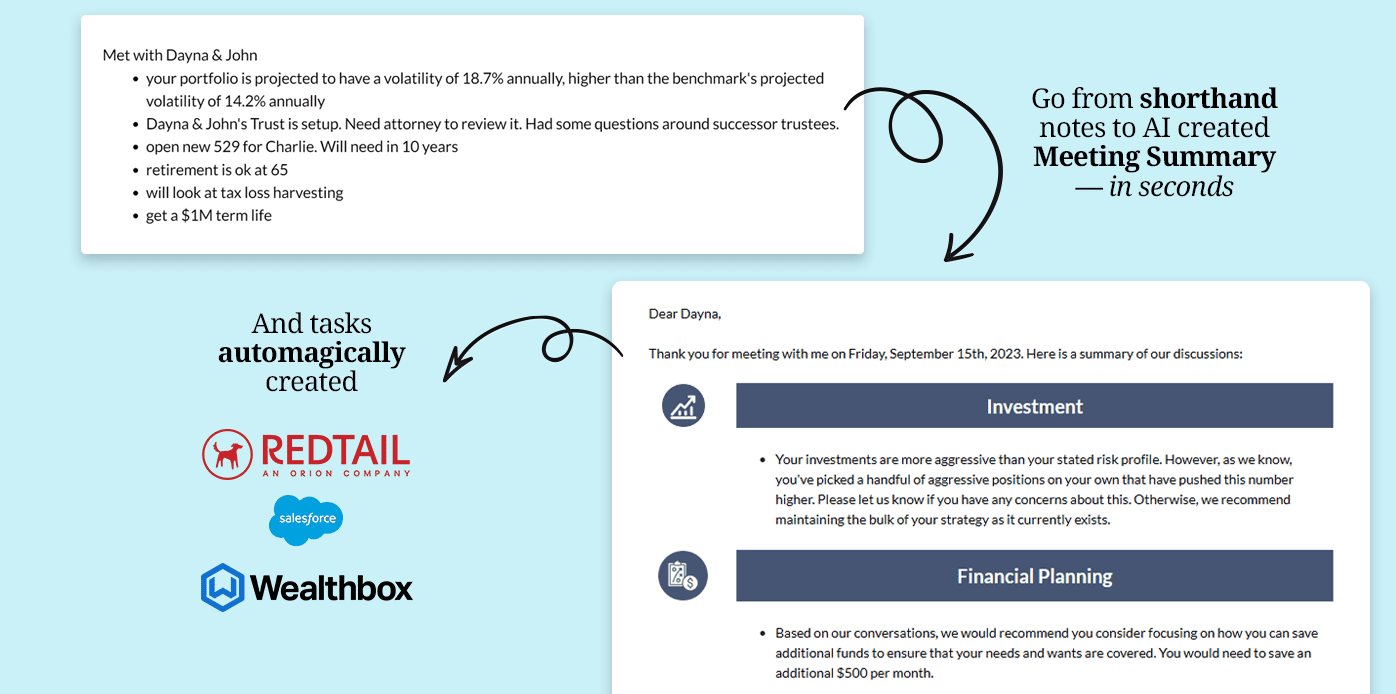

That's where Pulse360 steps in. Tailored for the modern financial advisor, it revolutionizes your practice management, transforming how you handle client documentation and communication.

With plans tailored to every need:

Time is as valuable as advice — let Pulse360 be the tool that streamlines your operations, allowing you to focus more on what you do best — advising clients.

Upgrade your practice today with Pulse360 and experience the difference in efficiency and client satisfaction.