I hope you get value out of this blog post.

Did you know that 72% of clients leave financial advisors due to poor communication?

Transforming your client relationships from transactional to transformational has never been more crucial.

Understanding your client's unique needs, maintaining open communication, and building trust are not just niceties—they're necessities.

As a financial advisor or coach, your primary objective is to guide your clients toward financial well-being.

But here's the thing:

You can't offer meaningful advice unless you understand their unique needs, goals, and pain points.

Understanding your client's needs is the cornerstone for establishing a fruitful, long-term relationship.

The first step in understanding your clients is to open up clear lines of communication.

You may think you're doing enough by sending occasional emails or newsletters, but that's just scratching the surface.

Personalized communication is key:

It goes beyond just addressing your clients by their first names. It involves tailoring your interactions to suit each client's preferences, needs, and concerns.

Here are suggestions on how you can add a personal touch to your communications in the usual channels (meetings, emails, and phone calls):

| Communication Channel | Strategy 1 | Strategy 2 | Strategy 3 |

| Meetings | Agenda customization: Ask clients what specific topics they want to cover and create an agenda accordingly. | Personal updates: Begin by inquiring about personal milestones or recent life events to build rapport. | Actionable takeaways: Summarize key points and outline next steps tailored to their unique financial goals. |

| Emails | Personalized subject lines: Use subject lines that directly relate to the client's financial matters. | Segmentation: Segment your email list based on client interests or needs for targeted content. | Follow-up: Reference specific topics discussed in previous meetings or calls to show attention to detail. |

| Phone Calls | Scheduled calls: Schedule calls in advance when possible, respecting the client's preference for a heads-up. | Personal touch: Start calls with a personal greeting and reference any recent events or milestones. | Tailored information: Discuss matters specifically relevant to the individual client, aligning with their interests and needs. |

Personalized communication is all about making your clients feel valued and understood.

By taking these extra steps, you show that you're not just interested in their finances but in their lives as a whole.

This fosters a deeper, more trusting relationship, which is invaluable in the financial advisory business.

Active listening isn't just nodding your head while the client talks:

It's about fully concentrating, understanding, and responding thoughtfully to what your client is saying.

This skill is crucial for financial advising because it helps you catch the nuances that could be pivotal in providing personalized advice.

Here are three ways you can show that you’re actively listening:

By taking the time to understand your client’s needs, you're laying down a strong foundation for a relationship that’s not just transactional, but transformational.

On the other hand, there are times when active listening can actually lead to a more profitable outcome (but don’t make this the goal).

Take this story about Sarah as an example:

Sarah had a long-time client named John. One time, she met with him on a scheduled routine meeting to discuss his portfolio. John mentioned in passing that he was considering investing in real estate, specifically in rental properties, as a way to diversify his assets.

Instead of brushing off the comment or immediately offering generic advice, Sarah picked up on John's subtle interest and asked him more questions. What attracted him to real estate? Did he have a particular market in mind? What was his risk tolerance for this kind of investment?

By digging deeper, Sarah discovered that John had recently inherited a property and was interested in turning it into a rental unit. His interest in real estate wasn't just a whim — it was a carefully considered idea.

Realizing the opportunity, Sarah spent the next few weeks researching real estate investments, including tax implications, the potential return on investment, and management costs. She then tailored a comprehensive investment strategy for John, aligning it with his overall financial goals.

Not only did John go ahead with the real estate investment, but he also increased his assets under Sarah's management to cover this new venture. Sarah's firm earned a new revenue stream by managing the real estate property, and John was so pleased with the personalized service that he referred two high-net-worth individuals to Sarah.

Active listening is more than just a good interpersonal skill — it's a business strategy.

By taking the time to truly understand her client's needs, Sarah was able to offer a personalized solution that not only satisfied the client but also grew her business in a meaningful way.

Trust is the currency of any successful client-advisor relationship, especially in the financial industry where sensitive and personal matters are discussed.

Building trust isn't an overnight achievement — it's an ongoing process that requires consistent transparency on your part.

? Related: 5 Tips for Building Trust with Your Clients

Money talks, but it also complicates relationships when not handled transparently.

To avoid misunderstandings that could erode trust, it's crucial to be upfront about your fees and charges.

Here are key strategies that you can use when discussing financial matters:

| Strategy for Financial Transparency | Explanation |

| Initial consultation on fees | Discuss your fee structure during the first meeting to set clear financial expectations from the start. |

| Written agreements | Always put the financial details, including fees and services provided, in a written agreement to avoid future misunderstandings. |

| No hidden charges | Be upfront about any extra costs that might occur during the service. Transparency means no unpleasant financial surprises. |

| Monthly newsletters on finances | Use monthly newsletters to give a transparent overview of market trends, changes in financial regulations, and how these may impact the client. |

| Personalized financial reports | Send quarterly or annual reports that are tailored to each client's financial status, providing a transparent view of asset management. |

| Immediate updates on significant changes | For major market events or drastic changes in financial plans, provide immediate updates to maintain transparency. |

I know that discussing financial matters can be delicate. However, a well-prepared script can make the conversation less awkward and more productive.

Here's an example script that a financial advisor or coach can use to discuss fees, charges, and other financial matters transparently:

| Speaker | Script |

| Advisor | "Hello [Client's Name], thank you for taking the time to meet with me today. How are you doing?" |

| Client | "I'm doing well, thank you. I'm excited to discuss my financial plans." |

| Advisor | "Before we dive into the details of your financial goals and strategies, I think it's important that we have a clear understanding of the financial aspects of our working relationship. Is that okay with you?" |

| Client | "Sure, that sounds reasonable." |

| Advisor | "First, let's talk about the fee structure. I charge a flat rate for the financial planning process, and then there's a percentage-based fee for assets under management. I believe in full transparency, so you will find all of this information detailed in the written agreement." |

| Client | "Alright, that sounds straightforward." |

| Advisor | "Additionally, I want you to know that there are no hidden charges. If there are any extra costs associated with specific services or transactions, I will inform you in advance. Does that work for you?" |

| Client | "Yes, I appreciate the honesty." |

| Advisor | "To keep you in the loop, I will be sending you monthly newsletters that offer a snapshot of market trends and how they could affect your portfolio. I will also provide you with personalized quarterly reports so you can easily track your financial progress. How does that sound?" |

| Client | "That sounds very thorough, I like it." |

| Advisor | "Is there anything else you'd like to know about the financial aspects of our advisory relationship?" |

| Client | "No, I think you've covered everything." |

| Advisor | "Fantastic! Now that we've gotten that out of the way, let's move on to discussing your financial goals and how we can work together to achieve them." |

The script above is just a guideline — but it provides a structured way to approach potentially awkward financial discussions.

By setting a professional yet friendly tone and being transparent from the get-go, you can make the conversation as comfortable as possible for both parties.

Trust is often nurtured in small, consistent actions rather than grand gestures. One of the best ways to build trust is by keeping your clients informed.

At the very least, you want to send out the following:

Building trust through transparency isn't just good ethics — it's also good business.

I’ve got a table here that might help you figure out the type of update, format, and frequency of these updates:

| Type of Update | Suggested Format | Recommended Frequency |

| Market trends | Monthly newsletter | Monthly |

| Portfolio performance | Personalized report | Quarterly |

| Financial news impact | Email alert | As needed |

| Milestone tracking | Email or dashboard | Quarterly |

| Regulatory changes | Email or webinar | As needed |

| Investment opportunities | Phone call or email | As needed |

A transparent relationship encourages open dialogue, builds mutual respect, and most importantly, it makes it easier for you to do your job effectively.

Remember, a trusting client is a loyal client, and loyalty is invaluable in the competitive world of financial advising.

? Related: 3 Steps Financial Advisors Can Take to Communicate Value to Clients

The truth is:

Cookie-cutter advice won’t cut it anymore. Clients want—and deserve—strategies that are tailored to their unique financial situations and life goals.

Let's delve into how you can offer personalized financial solutions that resonate with your clients:

The one-size-fits-all approach is outdated. Your clients have unique financial landscapes that require individualized attention.

Personalizing your financial guidance is essential for establishing a deep, trusting relationship with your clients.

If you’re not sure how, here are various methods for tailoring your financial advice:

| Method for Personalization | How to Implement |

| Understand financial history | Take the time to explore your client's past financial behavior, including spending habits and previous investment choices. |

| Tailor asset allocation | Customize the asset distribution in your client's portfolio based on their risk tolerance and financial goals. |

| Scenario planning | Discuss various financial scenarios, from best-case to worst-case, to prepare your client for different possibilities. |

| Identify core goals | Work with your client to identify their primary financial objectives, whether it's retirement, home ownership, or education funding. |

| Milestone tracking | Set interim goals and track progress, providing updates and making adjustments as necessary. |

| Regular re-assessment | Periodically review and update the financial plan to ensure it remains aligned with your client's changing needs and goals. |

Financial planning isn't just about numbers — it's about helping your clients realize their dreams and aspirations.

Creating a tailored, goal-oriented financial plan is a multi-step process that involves careful analysis, consultation, and ongoing adjustments.

This approach ensures that the financial plan is not just generic recommendations:

But a personalized roadmap that aligns with your client's unique financial goals and circumstances.

I converted my step-by-step guide into a table format so it’s easier to digest:

| Step Number | Action Step | Brief Description |

| Step 1 | Initial consultation | Conduct an in-depth meeting to understand the client's financial history and goals. |

| Step 2 | Data collection | Gather all necessary financial data, such as income, expenses, assets, and liabilities. |

| Step 3 | Financial analysis | Analyze the collected data to assess the client's current financial standing. |

| Step 4 | Goal setting | Collaboratively set SMART financial goals with the client. |

| Step 5 | Strategy development | Create a tailored investment strategy based on the financial analysis and goals. |

| Step 6 | Draft the financial plan | Compile all the information into a comprehensive financial plan document. |

| Step 7 | Client review | Present the draft plan to the client for feedback and make necessary adjustments. |

| Step 8 | Implementation | Execute the strategies outlined in the approved financial plan. |

| Step 9 | Ongoing monitoring | Regularly track the plan's performance and make adjustments as needed. |

| Step 10 | Periodic reviews | Conduct regular reviews with the client to assess progress and make further adjustments. |

Offering personalized financial solutions doesn't just satisfy your client's expectations — it exceeds them.

This level of personalization enriches your client relationships, making them more rewarding for both parties involved.

? Related: Financial Advisors: Quit Talking about Returns. Start Talking About

The financial landscape is ever-changing, and influenced by market conditions, economic policies, and even global events.

Consequently, a financial plan is not a 'set it and forget it' endeavor:

It's a dynamic strategy that requires regular follow-up and adjustments to stay aligned with your client's goals and the current economic climate.

Here's how to make sure your financial plans remain relevant and effective.

Ongoing client interactions and regular check-ins are more than just routine touchpoints — they are essential elements for the longevity and success of a client-advisor relationship.

Some of the most important reasons include:

I already discussed a great deal about providing regular updates, including the type of updates, the format, and the frequency.

But since we’re talking about regular check-ins here, I will expand that table a little bit to cover most of the client check-ins you need to do:

| Type of Check-in | Frequency | Format | Purpose |

| Quarterly reviews | Every 3 months | In-person or video conference | Comprehensive updates on portfolio performance and life changes. |

| Monthly updates | Every month | Email or brief phone call | Snapshot of portfolio performance and significant market events. |

| Event-triggered check-ins | As needed | Phone call or email | Immediate reassessment and adjustment of financial plans due to significant life events. |

| Annual comprehensive review | Once a year | In-person or video conference | In-depth review of the entire financial plan, long-term goals, and strategies. |

| Weekly or bi-weekly market updates | Weekly or bi-weekly | Email newsletter or automated dashboard | Updates on market trends and news. |

| Emergency communication | As needed | Immediate phone call or email | Quick decisions in response to significant market downturns or impactful financial news. |

Flexibility is key in financial planning.

You must be prepared to pivot your strategies based on performance and changing circumstances.

Some of the things you might need to do include:

This isn't just about maintaining the plan's effectiveness — it's about showing your clients that you are actively involved in their financial well-being.

This proactive approach fosters trust and demonstrates your commitment to helping your clients achieve their financial goals, further solidifying your value in their lives.

Navigating behavioral finance goes beyond expertise—it demands the right tools.

Uncover biases with diagnostic assessments, then streamline your documentation with Pulse360.

Consider the variety of plans tailored to every need:

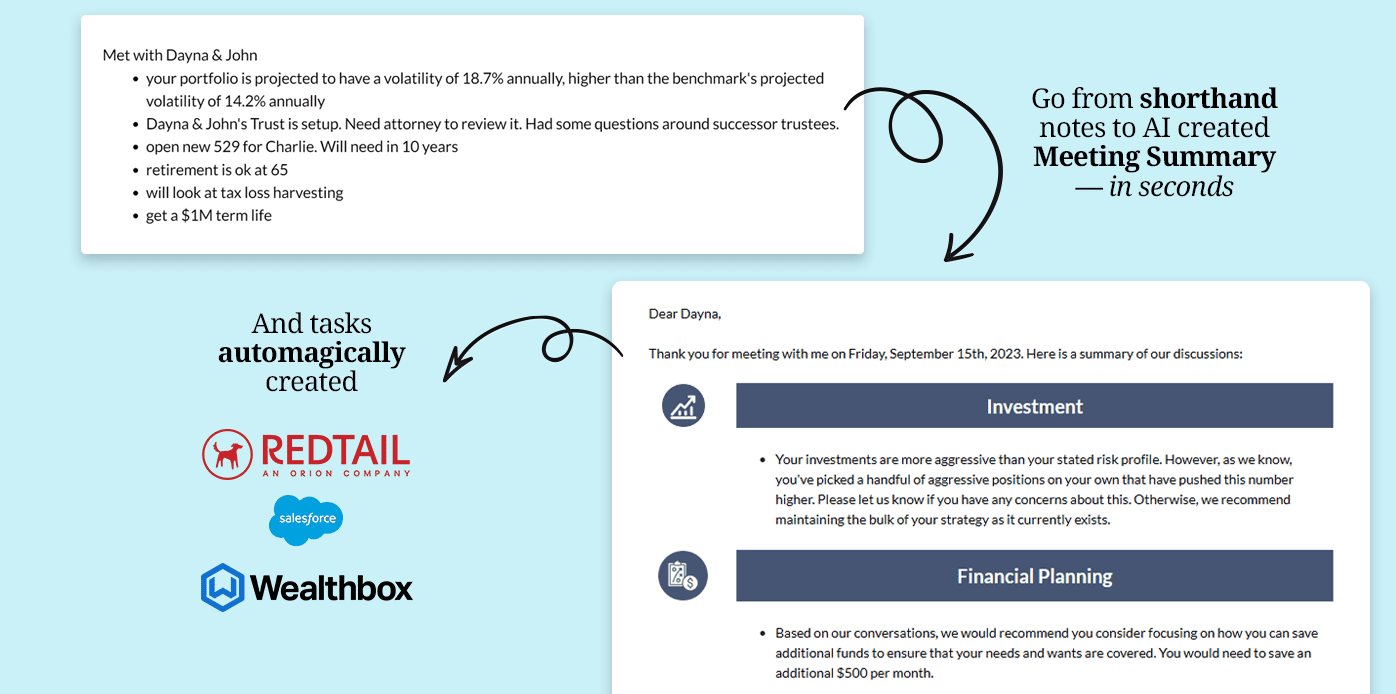

Tailored for financial advisors, this platform simplifies creating professional summaries and emails.

With the AI-powered NoteGenius, process meeting notes 80% faster, capturing every client insight accurately.

Shift from manual documentation to Pulse360, elevating your practice and client relationships.