I hope you get value out of this blog post.

Did you know that according to a survey, only 36% of the U.S. workforce was engaged in their organizations in June 2021, with 15% actively disengaged?

The lack of engagement often results from the absence of a clear value statement, while employees dedicated to a greater purpose tend to be more engaged.

In this guide, let’s talk about value statements, what their role is, how to create a powerful value statement yourself, and more.

A value statement is a declaration that illustrates the core beliefs and guiding principles of an organization.

In a way, it is a reflection of the company's identity, providing a clear picture of what it stands for and believes in.

The purpose of a value statement is multifold:

Moreover, a value statement conveys to the outside world, including your clients and stakeholders, your company's dedication to its values, fostering trust and credibility.

Value statements, mission statements, and vision statements are important parts of an organization's strategy, each with distinct purposes and conveying various aspects.

To expound:

In contrast, a value statement centers on the organization's core beliefs and principles in its business operations and stakeholder interactions.

While mission and vision statements are about the organization's 'what' and 'where,' the value statement is about the 'how' and 'why.'

It is the ethical compass that guides the organization's actions and behaviors.

Value statements play a pivotal role in the financial advisory sector, shaping the way advisors interact with their clients and conduct their business.

They serve as a foundation for building strong, lasting relationships with clients, differentiating advisors from their competitors, and fostering client trust and loyalty.

In the financial advisory field, where trust and credibility are paramount, value statements can be a powerful tool for building and strengthening client relationships.

They offer a clear, concise view of the advisor's core values and principles, aiding clients in understanding the advisor's stance and what to anticipate in the relationship.

A well-crafted value statement can help establish a strong connection with clients, fostering a sense of trust and mutual understanding.

? Related: 5 Tips for Building Trust with Your Clients

The market is highly competitive, with numerous advisors offering similar services.

In such a scenario, a compelling value statement can serve as a key differentiator, setting an advisor apart from the competition.

It communicates the unique value proposition of the advisor, highlighting how they are different and why clients should choose them over others.

By expressing values that resonate with clients' needs and expectations, advisors can establish a distinct identity and become the preferred choice for their target clients.

? Related: How do you stand-out to your prospects?

By consistently living up to their value statements, financial advisors can demonstrate their commitment to their values — thereby building credibility and trust with their clients.

This, in turn, can lead to increased client loyalty and retention.

Moreover, a strong value statement can also attract new clients who share similar values, thereby aiding in client acquisition and business growth.

Creating a powerful value statement requires a deep understanding of your unique value proposition, your target clients, and the core values that guide your business.

By combining these elements, you can craft a compelling statement that resonates with your clients and sets you apart from the competition.

Here's how to create a value statement that resonates and reinforces the core ethos of your financial advisory practice:

An effective value statement should have the following characteristics:

Authenticity and specificity are crucial in crafting a powerful value statement.

To create a value statement that resonates with your clients, you need to understand their needs and expectations.

Here are some steps to help you align your value statement with your clients' requirements:

| Step | Action | Specifics |

| Research client needs and preferences | Conduct surveys, market research, client interviews | Gather feedback, study industry trends, engage in one-on-one conversations with clients |

| Analyze and identify key themes | Data analysis, consultation with team, prioritize values | Analyze data, discuss with the team, prioritize important values |

| Draft the value statement | Reflect core values, incorporate client priorities, use clear language | Ensure core values are central, blend in client preferences, use clear and relatable language |

| Validate and refine | Feedback from trusted clients, revise as needed, finalize the statement | Get feedback, make revisions, finalize the statement |

| Integrate and communicate | Incorporate across channels, staff training, client communication | Consistently represent the statement, train staff, actively communicate with clients |

| Monitor and update | Regular reviews, adapt to changes | Periodically review, update as needed to reflect client needs or market trends |

By following these steps, you can create a powerful value statement that not only reflects your core values but also resonates with your target clients.

Examining successful value statements from leading financial advisors can provide valuable insights and inspiration for crafting your own.

Here are a few examples:

"To take a stand for all investors, to treat them fairly, and to give them the best chance for investment success."

Vanguard's value statement is clear, concise, and client-centric. It communicates their commitment to fairness and their goal of helping investors succeed.

This value statement aligns with their reputation for low-cost index funds and their client-owned structure, reinforcing their unique value proposition.

"We're built to serve. We're here for you – ready to listen, support and navigate this together." (paraphrased)

Edward Jones' value statement emphasizes their commitment to service and their readiness to support their clients.

It reflects their focus on building strong, personal relationships with clients, differentiating them in a market often seen as impersonal and transactional.

"We make the complex simple and the tough decisions clear, so you can move forward confidently." (paraphrased)

Merrill Lynch's value statement highlights its ability to simplify complex financial matters and provide clear guidance, giving clients the confidence to move forward.

This aligns with their role as advisors, demonstrating their value in helping clients navigate the complexities of financial planning.

Once you have created a powerful value statement for your financial advisory business, the next step is to effectively implement and communicate it to your clients and stakeholders.

Effectively conveying your value statement to clients is important for reinforcing your commitment to your values and ensuring clients understand and appreciate them.

Here are some strategies to effectively communicate your value statement:

Using these strategies will ensure that your value statement is not just a passive declaration but an active, integral part of your client relationships and business practice.

This consistent and varied communication approach helps solidify your reputation as an advisor who not only states your values but lives by them.

Integrating your value statement into every facet of your financial advisory business is essential to creating a cohesive and authentic brand experience for your clients.

Here’s how you can weave your value statement into various aspects of your business operations:

By systematically embedding your value statement into all aspects of your business, you ensure a consistent and authentic experience for everyone who interacts with your firm.

This integration reinforces your commitment to values and boosts credibility and trust with clients and team members.

Evaluating the impact of your value statement on client relationships is important for understanding its effectiveness and for making informed adjustments.

Here's how financial advisors can measure this impact:

Through these methods, you can gain insights into how your clients perceive and value your commitment to your stated principles.

This information guides future strategies, marketing, and service improvements, aligning your practice with its values in a way that resonates with clients.

Value statements are pivotal in the financial advisory sector. They guide how advisors interact with clients and conduct business.

A well-crafted value statement builds strong client relationships, differentiates advisors, and fosters trust and loyalty.

By aligning your value statement with your core values and client needs, you can effectively communicate your unique value proposition.

Consistent implementation of your value statement and measuring its impact on client relationships drive success in the competitive financial advisory market.

As we've explored the importance of value statements in financial advisory, it's clear that conveying your unique values is crucial.

But beyond just stating your values, you need efficient tools to operationalize them in your practice:

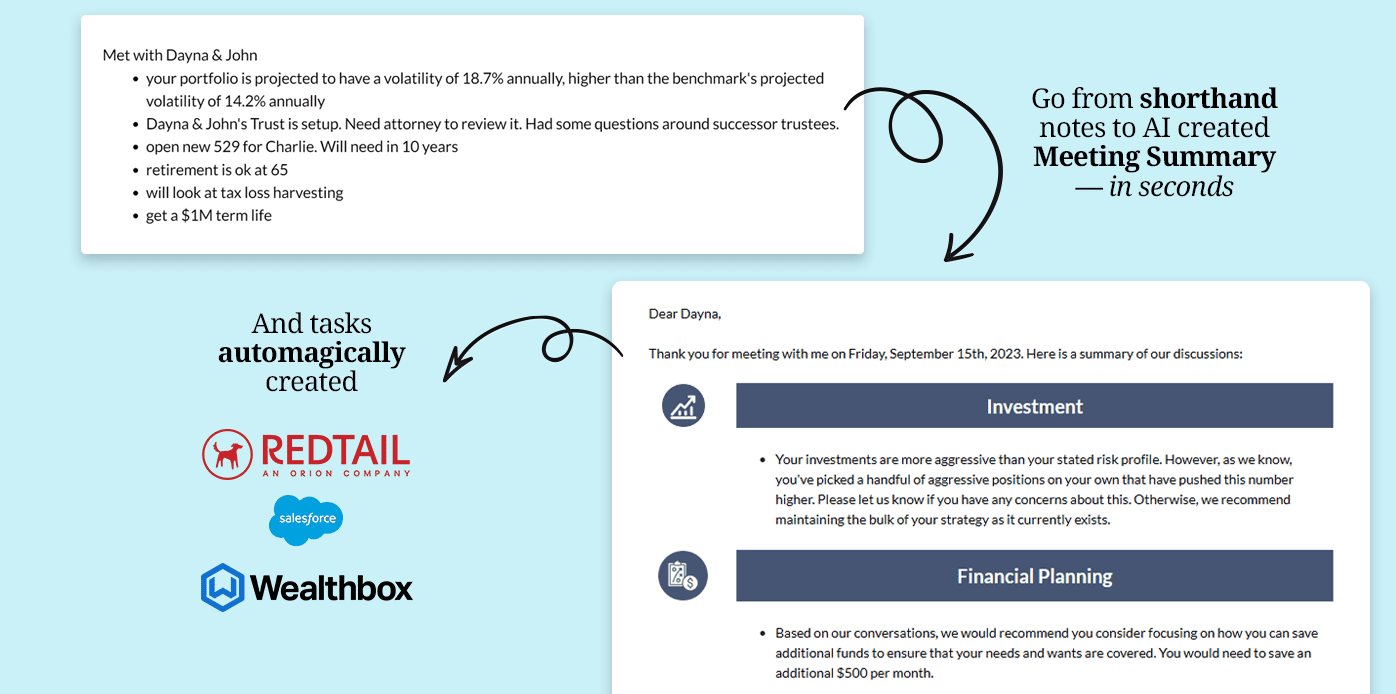

Pulse360 excels in this regard. Designed for financial advisors, it streamlines your documentation, ensuring consistent reflection of your values in client interactions.

With plans tailored to every need:

With Pulse360, you're not just adopting a tool; you're enhancing the way your values are integrated into every facet of your client service.

Embrace Pulse360 and elevate your practice today.