I hope you get value out of this blog post.

Did you know that in the increasingly competitive financial advisory market, carving out a niche could be the key to standing out and securing your success?

According to the latest CEG Worldwide research, 70% of top financial advisors, those who earn $1 million or more annually, focus on niche clients or a specific market segment.

Specializing in niche markets enables financial advisors to tailor services effectively and connect with clients on a deeper level, addressing specific needs and building lasting trust.

Well, niche targeting may sound new, but it’s simply a strategy where you focus on a specific segment of the market.

Unlike broad-market strategies, it focuses on a specific group of clients with unique needs and offers them services specific to their requirements.

For financial advisors, it translates to you honing in on particular demographics, industries, or interest groups.

This approach helps advisors stand out in a crowded market by offering services tailored to the specific needs of their chosen niche.

But why should you concentrate on niche targeting when there are so many different kinds of clients in need of financial guidance?

The answer lies in the power of specialization and the increasing demand for personalized financial advice.

Niche targeting is not just a strategy for market differentiation —it’s a fundamental approach to building a sustainable and thriving practice in the modern financial advisory landscape.

This targeted approach enables advisors to go beyond surface-level advice, offering deep dives into the financial situations and challenges unique to their niche.

As a result, advisors become invaluable partners to their clients, fostering trust and a strong advisor-client relationship that is difficult for competitors to disrupt.

Focusing on a specific niche can significantly enhance your effectiveness by allowing for more personalized service and targeted marketing efforts.

Here's how you and other financial advisors can effectively target your niche:

Tailored services go beyond the one-size-fits-all approach, focusing on the unique needs, goals, and circumstances of each client.

By developing services that specifically cater to your niche, you not only enhance client satisfaction but also significantly improve client retention and acquisition.

Here’s how financial advisors can craft these specialized offerings:

Understanding your niche involves recognizing the specific financial goals, challenges, and preferences of your target audience.

For financial advisors, this might mean segmenting clients based on life stages, professions, or financial objectives, and then identifying common needs within these segments.

Here are the specifics:

Once you understand your niche's unique needs, you can develop services that directly address these.

For example:

This level of specialization not only meets your client's specific needs but also distinguishes your practice in a crowded market.

Here are more examples of custom offerings:

Technology plays a pivotal role in enabling personalized service delivery.

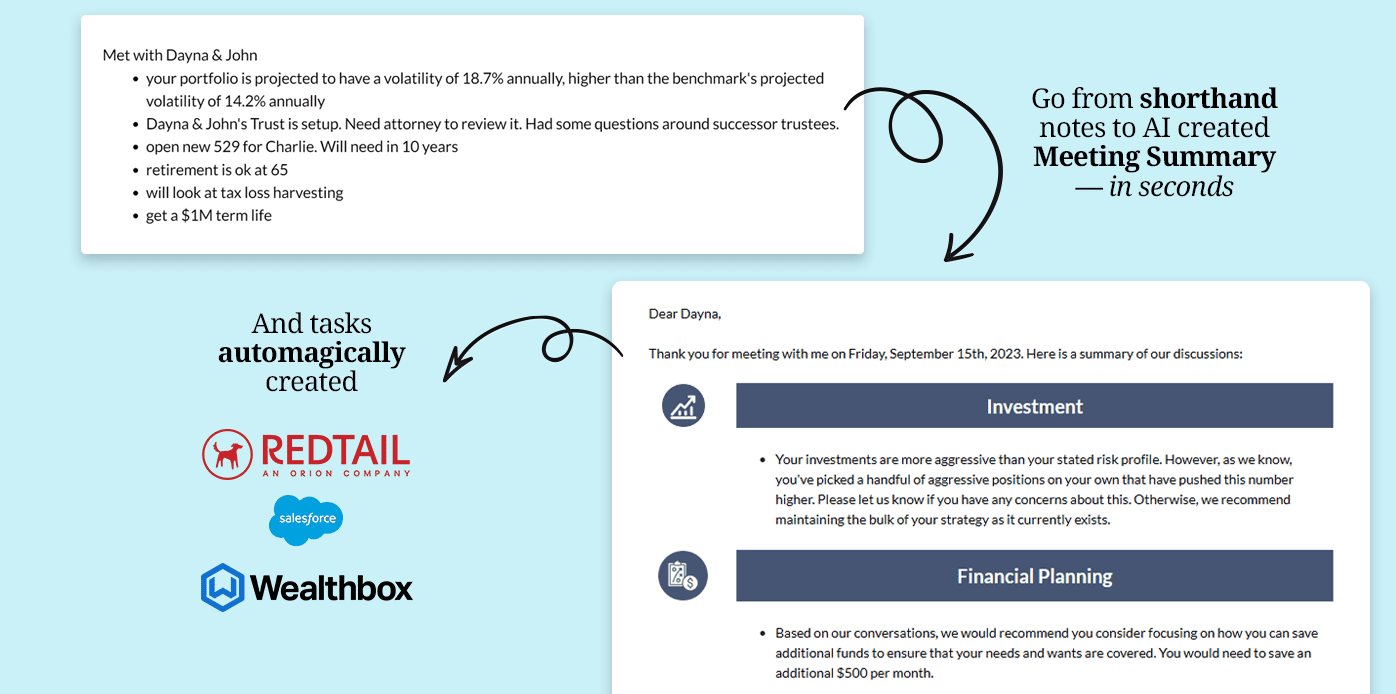

Platforms like Pulse360, designed with financial advisors in mind, streamline documentation and client communication processes.

Here are other examples of technology that can help:

Tailoring services is not a set-and-forget process.

It requires ongoing interaction with your clients to gather feedback and adapt services as their needs evolve.

Regular reviews, surveys, and open channels of communication help ensure that your offerings remain relevant and valuable to your niche.

Here’s what you can do:

For financial advisors, establishing expertise and credibility is paramount, not only to attract clients but also to maintain a lasting relationship built on trust.

Here's how financial advisors can build expertise and credibility:

Expertise begins with specialization.

By focusing on a specific niche, you can deepen your understanding of the unique financial situations, challenges, and goals that your clients face.

Here’s what you need to do here:

The financial world is constantly evolving, with new products, regulations, and strategies emerging all the time.

Staying abreast of these changes through continuous education and professional development is crucial.

Earning certifications relevant to your niche not only enhances your knowledge but also demonstrates your commitment to excellence for your clients.

Here’s an action plan you can follow:

Positioning yourself as a thought leader is a powerful way to build credibility.

This can be achieved through various channels, such as blogging, publishing articles, or speaking at industry events.

Sharing your insights on financial planning, investment strategies, and market trends not only helps educate your audience but also establishes your authority in your niche.

Here are examples of how you can do this:

Client testimonials and case studies are compelling tools for showcasing your expertise and the value you bring to your clients.

With permission, share stories of how you've helped clients achieve their financial goals, overcome challenges, or navigate complex financial situations.

These real-life examples can resonate strongly with potential clients, providing tangible evidence of your skills and the positive impact of your advice.

Here’s what you should do here:

These platforms offer opportunities for collaboration, learning, and sharing best practices.

Moreover, participating in community initiatives or financial education programs showcases your dedication to your profession and the financial wellness of the wider community.

Action plan:

Now let’s talk about the actual marketing strategies you can do.

These strategies should not only capture the attention of your target audience but also resonate with their unique needs and preferences.

Here’s how financial advisors can leverage specific marketing strategies for niche targeting:

SEO is important for enhancing the visibility of your online content, making it easier for potential clients to find you when they search for financial advice that pertains to your niche.

Here are important principles you need to know about SEO:

| Principle | Description | Example |

| Keyword Research | Start by identifying niche-specific keywords that potential clients are likely to use when searching for advice. | Use tools like Google Keyword Planner or SEMrush to find relevant keywords for your niche. |

| Content Creation | Develop high-quality, informative content that incorporates these keywords naturally. | Write blog posts, articles, and guides addressing common questions and topics relevant to your niche. |

| On-Page SEO | Optimize your website's on-page elements, such as titles, headings, and meta descriptions, with target keywords. | Ensure titles, headings, and meta descriptions on your website contain relevant keywords to improve search engine visibility and user engagement. |

| Backlink Building | Acquire backlinks from reputable sites within the financial industry or related niches. | Secure backlinks from trusted financial websites, signaling to search engines that your content is valuable and authoritative. |

While SEO works to improve your organic reach, targeted online advertising allows you to directly reach specific segments of your target niche.

Platforms like Facebook, LinkedIn, and Instagram offer advanced targeting options that let you segment audiences based on demographics, interests, behaviors, and even job titles.

Create ads that resonate with the specific characteristics of your niche:

Then, you can implement retargeting campaigns to reconnect with users who have visited your website but did not take a specific action, such as:

Retargeting can significantly increase conversion rates by keeping your brand top of mind.

Creating valuable, niche-specific content not only establishes you as an authority in your field but also plays a crucial role in attracting and retaining clients.

Here’s how you can expand your content creation efforts as a financial advisor:

| Content Type | Action | Description |

| Blogs and articles | Identify relevant topics | Start by identifying the questions, concerns, and interests of your target niche. Use tools like Answer the Public to find what your audience is searching for online. |

| Provide in-depth analysis | Offer comprehensive insights, advice, and solutions. Each piece should aim to add value, whether through solving a problem, offering financial guidance, or presenting trends. | |

| Use engaging formats | Incorporate various formats such as lists, how-to guides, and case studies to make your content more engaging and accessible. | |

| Ebooks and whitepapers | Deep dive into topics | Ebooks and whitepapers allow for a deeper exploration of topics important to your niche. Showcase your expertise and provide valuable resources. |

| Offer as lead magnets | Utilize these resources as lead magnets to build your email list. Prospects can receive valuable information in exchange for their contact details. | |

| Promote on multiple channels | Share your ebooks and whitepapers across your website, social media, and email newsletters to reach a wider audience. | |

| Webinars and online workshops | Plan educational sessions | Plan and host webinars and workshops on financial strategies and topics pertinent to your niche. Ensure they are informative, engaging, and interactive. |

| Include Q&A segments | Incorporate Q&A segments to address specific audience questions, fostering a deeper connection and understanding. | |

| Record and repurpose content | Record sessions for those unable to attend live. Repurpose the content into blog posts, short videos, or podcast episodes for wider dissemination. |

Networking, especially within niche markets, is an important element of a successful financial advisory practice.

Attending niche-specific networking events helps you stay updated on the latest trends, challenges, and solutions in your field.

Here’s what you can do here:

Webinars, virtual conferences, and online forums provide a convenient and effective way to connect with a broader audience, overcoming geographical constraints.

Engage with your audience through these platforms to share knowledge, insights, and services directly, increasing your reach and influence within your niche.

Membership and active participation in professional associations relevant to your niche present invaluable opportunities for growth, learning, and networking.

These associations are often the hub for professionals seeking to advance their knowledge, skills, and careers.

Here’s what you need to know:

These activities not only demonstrate an advisor's commitment to the profession but also the willingness to contribute to the broader community's knowledge and well-being.

Adopting niche targeting requires a strategic blend of dedication, adaptability, and continuous innovation.

It's essential to remain fluid in your approach — always ready to evolve your strategies to meet the shifting demands of your niche.

Keep learning and networking to stay ahead of trends. Personalized, value-driven content that connects with your audience is key.

Wrapping up, where personalized service and operational efficiency are paramount, Pulse360 stands as a beacon of innovation and support.

Understanding the unique challenges that come with niche targeting, Pulse360 is designed to empower financial advisors with tools that transform the way they engage with their clients and manage their practice.

With plans tailored to every need:

Transitioning from manual documentation to Pulse360 not only streamlines your operational tasks but also significantly enhances your ability to deliver personalized, timely advice to your clients.

Try out Pulse360 and experience the difference in efficiency, client satisfaction, and overall practice growth.

Elevate your financial advisory practice with Pulse360 today, where technology meets personalized client engagement.